Table of Contents

Insurance virtual assistants help insurance agents every day. These virtual assistants handle policy updates, reply to client questions, and sort documents. Agents with a virtual assistant often have more time for clients and sales, making their operations smoother and more efficient. Many agencies that work with reliable providers like Callnovo experience even better results — with well-trained, multilingual assistants who quickly adapt to agency workflows and help improve service response times. A insurance virtual assistant can truly change how an agency runs, and with the right partner, the benefits come faster and easier.

Insurance Virtual Assistants in the Modern Agency

What Is an Insurance Virtual Assistant

An insurance virtual assistant works from China. They know a lot about insurance and how it works. They use special software and understand insurance words. They do not work in your office, but they help your team every day. These assistants are different from regular helpers because they know insurance. They help with office work, answer calls, and talk to clients. They also help find new customers and do marketing. Their skills make them very helpful for insurance agencies.

Key Roles and Tasks

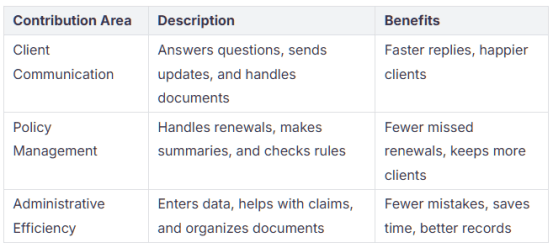

Bilingual virtual assistants do many jobs in insurance agencies.

- Administrative support: They enter data, organize papers, and set up meetings.

- Policy management: They help with renewals, update policies, and watch claims.

- Client communication: They answer questions, send reminders, and follow up with clients.

- Lead generation: They look for new clients, send emails, and help with marketing.

- Compliance: They keep records, check licenses, and make sure rules are followed.

- Workflow automation: They use tech to do simple jobs and save time.

Why Top Agents Use Bilingual Virtual Assistants

Insurance agents use bilingual insurance virtual assistants to save time and get more done. Insurance virtual assistants do simple jobs, so agents can sell and help clients. This means better service and more business. Virtual assistants answer faster and make clients happier. They help after hours and let agencies grow without more office space. When agents give these jobs to assistants, they spend more time with clients and less on paperwork. A virtual assistant helps agents handle more clients and grow their business.

A virtual assistant helps your team, makes work faster, and lets agents focus on important things.

How Insurance Virtual Assistants Power Agent Success

Streamlining Operations

Insurance agencies have many tasks that take a lot of time. Insurance virtual assistants help make these jobs easier for agents and their teams. They set up meetings, talk to clients, and help with claims. This gives agents more time for important work.

- Insurance virtual assistants answer calls, emails, and chat messages from customers. They reply quickly and tell agents about urgent problems.

- They remind agents to follow up with clients and set reminders. This helps agents not miss chances to help people.

- Virtual assistants update client records and handle renewals and cancellations. They also get policy documents ready.

- They type in data and keep information neat and organized in the CRM system.

- They help with claims by collecting papers, sending forms, and checking on claims.

- Virtual assistants help with marketing by sending emails, posting on social media, and making content.

A insurance virtual assistant can help your team do more and spend less time on paperwork. This lets agents help more clients.

Automating Communication

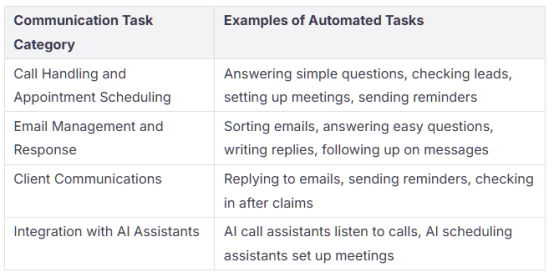

Good communication is very important in insurance. Insurance virtual assistants help by sending messages and reminders to clients. They answer emails, remind clients about renewals, and check in after claims. They also keep track of calendars, book calls, and remind the team about meetings.

Automating these jobs helps agents answer faster and give better service. Insurance virtual assistants make sure every client gets a reply and follow-up emails are sent on time. This helps clients get answers quickly and keeps them happy.

- Automation makes sure messages are sent on time and are correct. This helps clients trust the agency.

- Bilingual virtual assistants help with hard questions and are kind to clients.

- Using automation and virtual assistants means faster replies and 24/7 help.

- Telling clients about renewals and benefits helps keep them as customers.

Reducing Costs and Scaling Growth

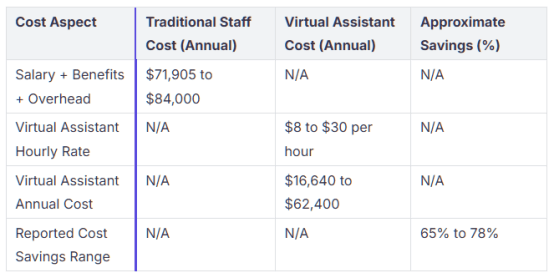

Insurance agencies want to grow without spending too much money. Virtual assistants are a flexible way to add help. They can work by the hour or on projects, so agencies do not pay for full-time workers. This saves money on office space, equipment, and benefits.

Small agencies can save a lot of money by using insurance virtual assistants. For example, hiring a virtual assistant instead of a $75,000 worker can save almost 76% in costs.

Insurance virtual assistants help during busy times without hiring more staff. They can work in different time zones, so agencies can help clients longer each day. By giving simple jobs to virtual assistants, agencies can grow and focus on bigger goals.

Real-World Impact of Virtual Insurance Assistants

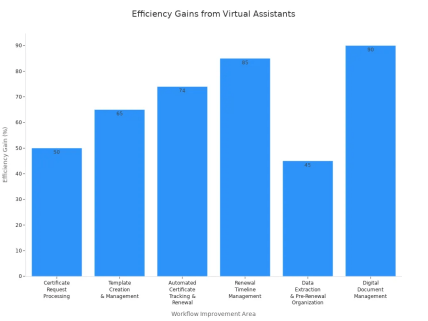

Many agencies have seen big changes after hiring bilingual virtual assistants. They save time, sell more, and keep more clients. Virtual assistants do office work so agents can focus on selling and helping clients.

A mid-sized agency got 30% more work done, processed policies 40% faster, and spent 25% less money after using virtual assistants. Clients were happier because they got help faster. The agency got more clients without giving agents more work.

Insurance virtual assistants also help find new clients and manage leads. They answer online questions, check if leads are good, and set up meetings. They keep in touch with possible clients, which helps agents do more and get better results.

Ready to Transform Your Insurance Aagency?

Insurance virtual assistants help top agents in many ways. They save time for agents and help them do more. Agents can spend more hours talking to clients and selling. Agencies do not need to hire as many people, so they save money. Virtual assistants know a lot and give good support. Teams can grow fast and handle more work as the business gets bigger. Virtual assistants can help at any time, day or night. This makes customers happier and helps the agency stand out.

Many insurance agencies choose reliable providers like Callnovo to access experienced, multilingual virtual assistants who can support their daily operations and improve customer satisfaction.

Learn more about their insurance VA solutions at https://callnovo.com/callnovo-multilingual-remote-virtual-assistant/

Request a free, customized quote at https://callnovo.com/request-a-quote/.