Table of Contents

Many Financial Firm founders hire a virtual bookkeeper to save money and avoid costly financial mistakes. Virtual bookkeeping provides real-time financial reports, keeps data secure, and offers flexible support when it’s needed most. For small businesses, having access to expert help — without the overhead — means owners can focus more on growth. Services like those provided by Callnovo ensure that this virtual bookkeeper services is not only reliable and scalable, but also tailored to the day-to-day needs of growing businesses.

Why Hire a Virtual Bookkeeper

Save Time and Money

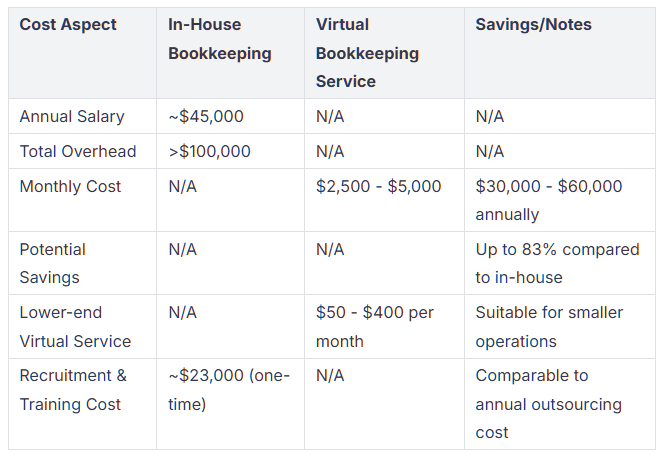

A virtual bookkeeper helps financial firms save time and money. Many founders see that hiring one costs less than having someone in the office. You pay less because you do not need to pay a big salary. You also do not need to pay for office space or extra benefits. The American Institute of Certified Public Accountants says switching to virtual bookkeeping saves about 30%. This is because you do not pay for things like payroll taxes or training.

Here is a table that shows the cost difference:

Virtual bookkeeping services also save time by using automation. Things like entering data, matching transactions, and scanning invoices happen fast. There are fewer mistakes. Founders can spend more time growing their business. They do not have to do as much paperwork. For many, hiring a virtual bookkeeper is a smart way to manage money. It helps them use their resources better.

Real-Time Financial Reporting

Virtual bookkeeping lets small businesses see their money details right away. A virtual bookkeeper uses cloud tools like QuickBooks Online, FreshBooks, and Zoho Books. These tools let founders check their numbers any time they want. Traditional bookkeepers might only update records once a month. Virtual bookkeepers give reports in real time.

- Virtual bookkeepers use cloud software for instant financial data.

- You can see reports at any time, not just during work hours.

- Automation makes reports faster and cuts down on paperwork.

- Founders get a clear view of their money with live updates.

Reduce Errors and Stay Compliant

In financial firms, even a small bookkeeping mistake—like misclassifying a transaction or missing a reconciliation—can trigger hefty fines or regulatory scrutiny. By 2025, founders must ensure every entry is accurate and compliant with SEC, FINRA, or other financial regulations to protect their reputation and avoid costly penalties.

A virtual bookkeeper uses specialized accounting software tailored for financial services, such as fund accounting and portfolio management tools, to track transactions in real time. They handle critical tasks with precision, including:

- Client billing management

- Expense allocation and tracking

- Monthly account reconciliations

This proactive approach not only keeps your firm audit-ready but also secures sensitive financial data through encrypted cloud platforms. With this foundation, founders can confidently focus on expanding assets under management and strengthening client trust, knowing their books are accurate and compliant.

Virtual Bookkeeper for Small Business Growth

Flexible and Scalable Services

A virtual bookkeeping service can grow with your business. Providers have different packages for each stage of growth. You can start with basic help or get full support. Many virtual bookkeepers use automation and cloud tools to handle more work as you grow. This keeps records correct, even when things get busy. Owners only pay for what they need. Some companies give live expert help and AI-powered tools. They may also offer fractional CFO options. These features help small businesses save money and change services as needed. Providers also adjust their help for different industries, so every business gets the right support.

- Packages go from simple to advanced.

- Automation keeps records right as work grows.

- Owners can add or drop services when needed.

Access from Anywhere

Virtual bookkeepers use cloud software, so founders can check money from anywhere. This helps people who travel or work in many places. Cloud accounting is now common, and most accountants use these tools. Owners see reports in real time and make fast choices, even when away. Mobile apps like QuickBooks and Netsuite let founders manage money on their phones. Secure online storage keeps data safe and easy to find. Remote access means no in-person meetings, so owners save time and travel money.

- Founders and bookkeepers can work from any place.

- Real-time data helps owners make quick choices.

- Secure cloud storage keeps money info safe.

Focus on Core Business

A virtual bookkeeper gives owners more time to grow their business. Experts handle the books, so owners worry less about tax dates and mistakes. Good records and up-to-date reports help with planning and strategy. Many small businesses save up to 30% and make fewer errors. This help lets owners spend more time on sales, marketing, and customers. Real stories show that businesses with virtual bookkeeping often grow faster and make better choices.

Virtual Bookkeeper vs. Traditional Bookkeeping

Cost and Value

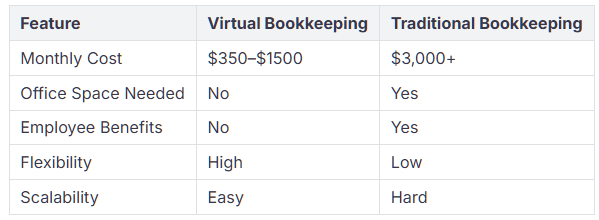

Small businesses look at prices when picking a bookkeeping service. Virtual bookkeeping costs about $150 to $900 each month. Traditional bookkeeping can cost over $3,000 every month. This is because of salaries, benefits, and office space. Equipment also adds to the price. Virtual services do not have extra costs like employee benefits or training. They also do not need office supplies. Cloud-based software means no need for servers or backup systems.

Technology and Security

Virtual bookkeeping uses new technology to help businesses work better. Cloud-based software gives updates right away. Owners can check records from anywhere. Automated tools help stop mistakes and finish tasks faster. Virtual bookkeepers use secure cloud storage with encryption to keep data safe.

Security is very important. Providers use strong access controls and watch for strange activity. They follow data protection laws and back up data often. Confidentiality agreements and good cybersecurity plans keep information safe. These steps help stop data loss or breaches. This matters because cyberattacks on small businesses are rising. Virtual bookkeeping platforms fix security problems faster than traditional systems.

Reliable Virtual Bookkeeping Service Starts Here

To stay compliant and competitive in today’s financial landscape, accurate, real-time bookkeeping is no longer optional — it’s essential. Callnovo provides experienced virtual bookkeepers who understand the specific needs of financial firms, from reconciliation to regulatory reporting. Whether you’re looking to streamline operations or scale with confidence, our team is here to support you.

Learn more: https://callnovo.com/callnovo-multilingual-remote-virtual-assistant/

Request a quote: https://callnovo.com/request-a-quote/