In the competitive arena of global finance, the quest for customer service excellence has led many to embrace German offshoring.

This strategic move – a highly–motivating trend – is a cornerstone of modern business strategies, particularly for banking customer experience (CX) & finance call centers.

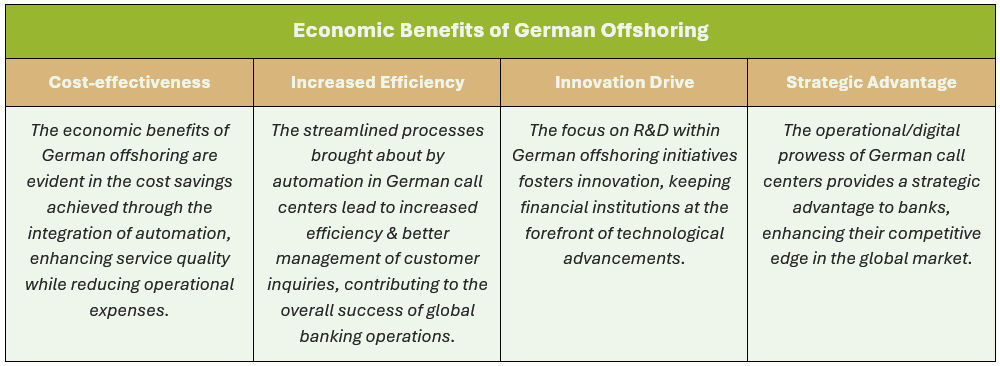

Let’s delve into the economic benefits of German outsourcing, showcasing how it can be a game-changer for your business to enhance its offshore banking customer experience.

We’ll explore how enhancing German consumer engagement through strategic offshoring leads to unparalleled customer loyalty & business growth.

Join us as we uncover the facets of German offshoring that make it a beacon of success for the banking and finance industry.

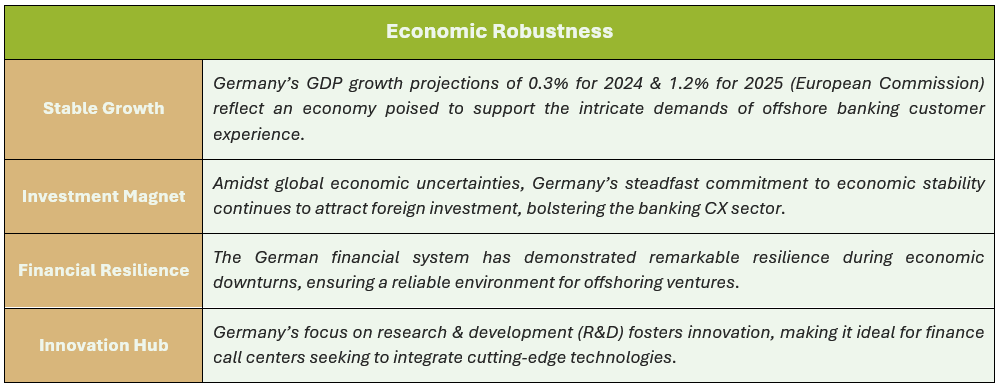

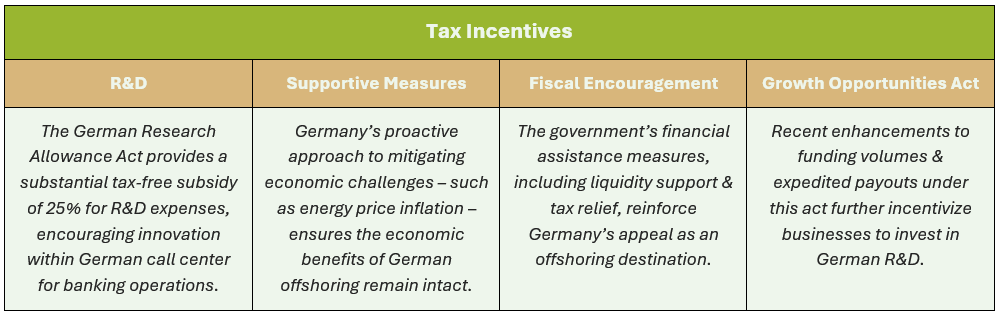

Germany’s Economic Stability & German Offshoring Appeal

The allure of German outsourcing is rooted in the country’s unwavering economic stability, which stands as a pillar for the global banking & finance sector.

Germany’s robust economy – characterized by resilience & growth – presents a compelling case for your business to enhance its banking CX & financing call centers.

The strategic advantages offered by Germany’s economic landscape are instrumental in attracting offshoring investments, positioning the nation as a bastion for digital banking solutions & excellence in customer service.

Role of German Call Centers in Global Banking

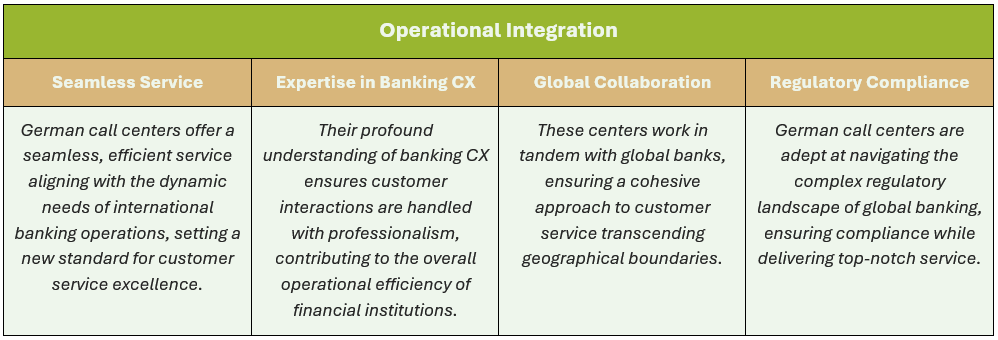

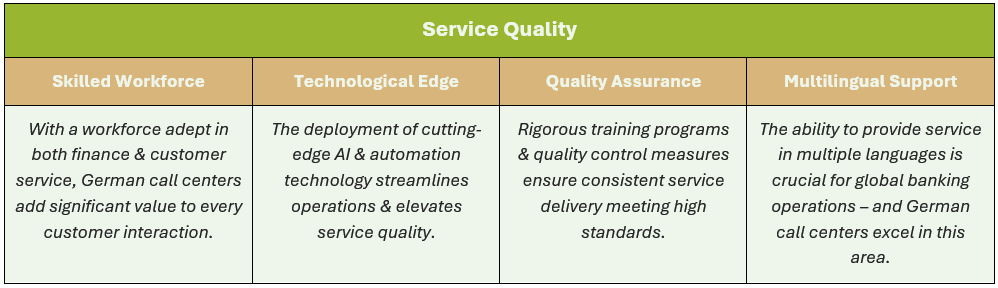

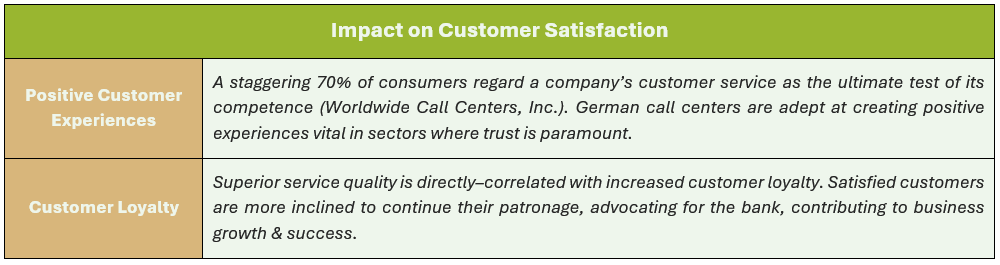

The integration of German call centers into the global banking framework has been transformative, establishing Germany as a hub for finance call centers that excel in operational efficiency & customer service excellence.

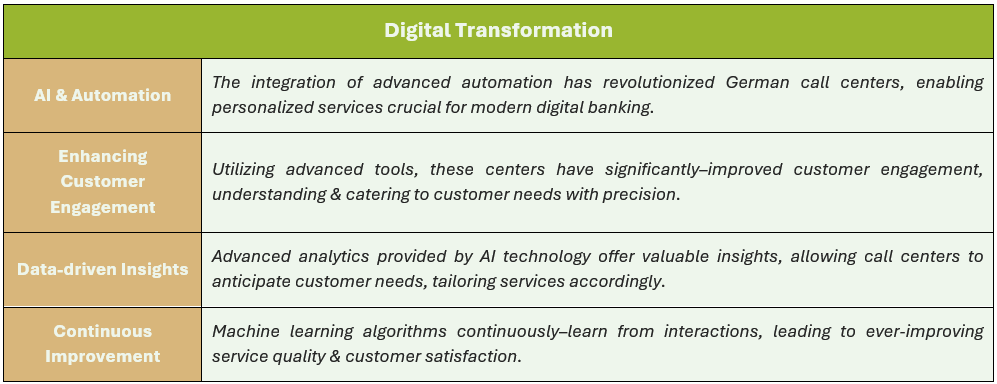

These centers are both pivotal in enhancing the offshore banking CX – and serve as a cornerstone for the digital banking revolution.

The role of German call centers in global banking is indispensable.

Their operational integration & embrace of digital transformation through advanced technology & automation have set new standards in customer service, contributing to the growth & success of banking and finance businesses in today’s fast-paced market.

Comparative Analysis: Cost Efficiency & Service Quality

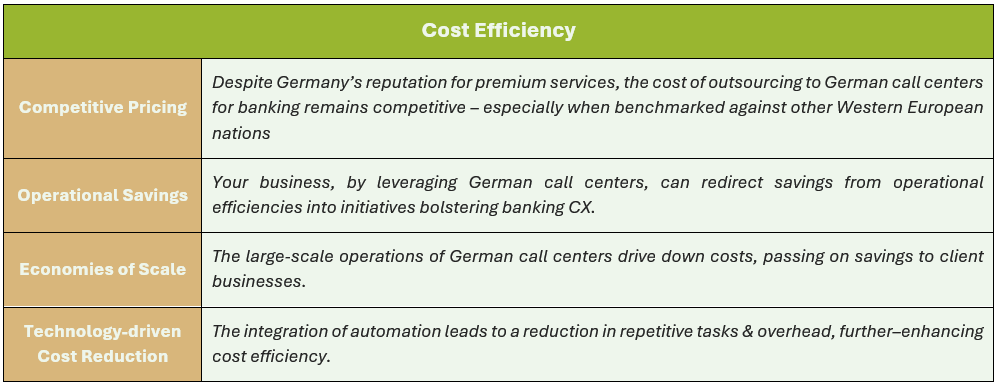

In the realm of global banking, the interplay between cost efficiency & service quality is a decisive factor for financial institutions considering German offshoring.

This delicate balance is not merely about fiscal prudence – but a strategic investment in excellence in customer service that yields dividends in the form of enduring customer loyalty & sustainable success.

German call centers present an ideal synergy of cost efficiency & service quality, positioning them as a prime choice for elevating international banking operations.

Callnovo Contact Center: Pioneering German Customer Service Excellence in Banking and Finance

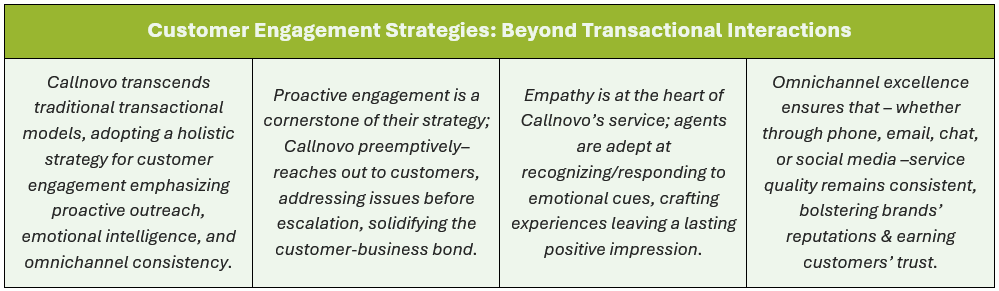

Diving into the world of German outsourcing, Callnovo Contact Center emerges as a vanguard, setting the standard for German-speaking customer service in the banking & finance sectors.

Their dedication to tailored German-speaking solutions has established them as a leader, driving innovation & customer satisfaction in a competitive industry.

Data-driven Insights

- The willingness to pay for quality service is evident; data from ChargeBack Gurus shows: a significant majority of customers are ready to invest more for superior experiences – a trend Callnovo’s service model perfectly–aligns.

- Success stories abound; Callnovo’s implementation of personalized engagement strategies has led to a notable increase in customer retention rates for German banking institutions, demonstrating the tangible benefits of their approach.

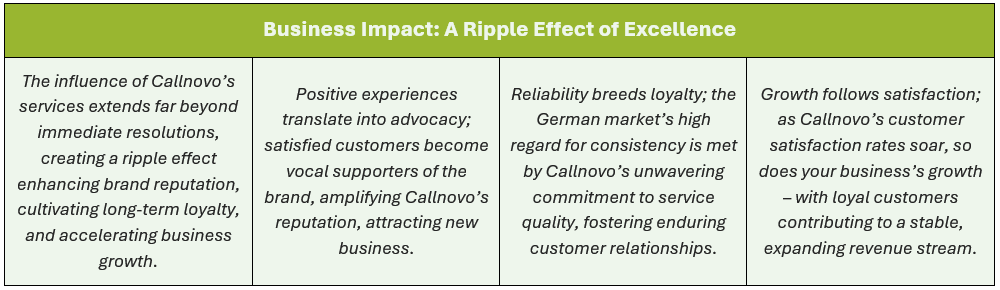

Callnovo Contact Center stands as a beacon of excellence in customer service, leveraging German outsourcing to deliver unparalleled service in the banking & finance industry.

Their strategic focus on cultural context, language precision, and customer engagement continues to yield significant business growth & customer loyalty.

Conclusion

In the intricate world of banking and finance, German outsourcing stands as a strategic beacon for enhancing customer service operations.

It’s clear…

To bolster your banking customer experience & financing call centers, Germany offers a compelling mix of technological advancement & skilled expertise.

The economic benefits of German outsourcing are evident, providing a cost-effective, high-quality solution to improve your offshore banking customer experience.

Callnovo Contact Center embodies this ethos, offering German call center for banking services prioritizing enhancing German customer engagement.

Their approach is a testament to the power of strategic offshoring in driving customer satisfaction & business growth.

Let’s reflect on the transformative potential of German outsourcing – an opportunity for banking & finance businesses to not just meet – but exceed – the evolving demands of their German-speaking clientele, ensuring long-term loyalty & success.