Table of Contents

Managing a Chinese-owned insurance agency means balancing policy updates, client communications, claims follow-ups, and endless administrative tasks — all while trying to grow your book of business. That’s where Mandarin-English bilingual insurance virtual assistants come in. These skilled remote professionals handle time-consuming back-office work, giving agents and brokers more freedom to focus on selling and building client relationships.

- Companies save over 60% in costs with virtual assistants.

- 91% of users say virtual assistants are excellent or good.

Top Benefits of Insurance Virtual Assistants

Improve Efficiency

Mandarin-English bilingual insurance virtual assistants help agencies work faster. They take care of boring and slow jobs. These bilingual virtual assistants do data entry, set up appointments, and handle claims. They also keep track of documents. When they do these jobs, agents can spend more time with clients. Agents can also solve harder problems. Mandarin-English bilingual virtual assistants answer emails, phone calls, and chat messages fast. This means customers do not wait long. People are happier when they get quick help.

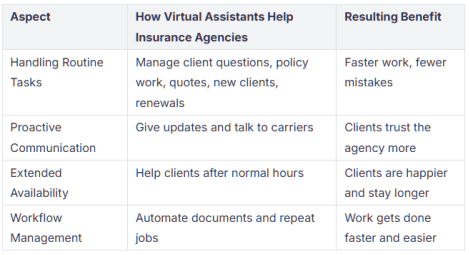

Some big ways virtual assistants help are:

- They collect and report data to help make better choices.

- They update policies and renewals to keep records right.

- They remind new and old clients about follow-ups.

- They help with leads so more people become clients.

Mandarin-English bilingual insurance virtual assistants give answers right away and work all day and night. Clients get help fast. Agencies can handle more work without hiring more people.

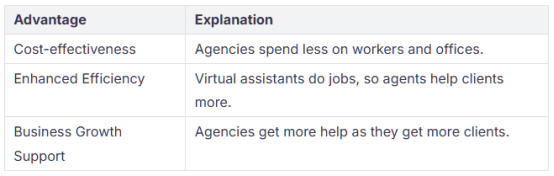

Cost Savings

Mandarin-English bilingual insurance virtual assistants help agencies significantly cut costs. Compared to hiring a full-time local employee—which can exceed $70,000 annually before adding benefits and office space—virtual assistants reduce expenses by up to 60%. Agencies only pay for the support they need, without additional costs like training, benefits, equipment, or office rent. Plus, outsourcing partners provide pre-trained professionals, reducing onboarding time and turnover. This flexible model allows agencies to scale staffing up or down based on business needs, freeing up resources to focus on growth.

Enhanced Customer Service

Better customer service is a big benefit of insurance virtual assistants. These helpers work all day and night. They answer client questions quickly and correctly. They do simple jobs like policy updates and checking claim status. They also set up appointments. Clients get fast answers and feel special.

Mandarin-English bilingual insurance virtual assistants help clients by giving quick answers in many ways. AI tools teach clients about insurance. This helps them make better choices. Agencies keep more clients because Mandarin-English bilingual virtual assistants ask for feedback and use it to get better.

With better service, agencies answer faster and make fewer mistakes. Clients have a good experience. This helps agencies grow and keep strong relationships.

How Insurance Mandarin-English Bilingual Virtual Assistants Work in Real Agency Operations

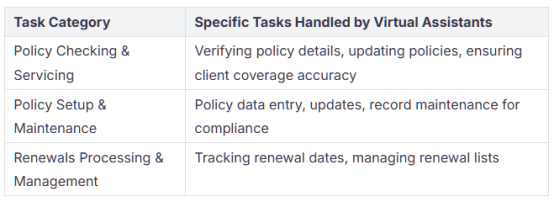

Policy Updates and Data Entry

Insurance virtual assistants do many jobs for agencies. They update client records and check policy status. They keep important documents in order. These bilingual insurance virtual assistants get applications ready and handle billing. They remind clients about payments. They also work on mortgagee changes and endorsements. They download carrier data too. By entering and cleaning up data, they stop mistakes. This keeps information correct. Insurance virtual assistants check for errors often. They remove duplicates and fix problems. This helps agencies follow rules and work better.

Client Follow-ups and CRM Management

A insurance virtual assistant keeps client information neat and current. They look up leads and sort contacts. They send emails that fit each client. Bilingual insurance virtual assistants set up calls and make quotes. They follow up with leads often. They use CRM tools to send reminders for renewals and payments. They write down every step and use scripts. This way, no lead follow-up is missed. This helps more leads become clients. It also helps the agency build strong client bonds.

Claims Processing

Mandarin-English bilingual virtual assistants make claims easier to handle. They take in claims and check policies. They put documents in order. They enter claim details and check for missing info. They talk to adjusters when needed. These virtual assistants follow the right steps and help spot fraud. Automated systems give updates right away. They cut down on paperwork. Insurance agencies can finish claims faster and make fewer mistakes. This makes customers happier.

Workflow Automation

Insurance virtual assistants use automation for daily jobs. They help with policy management and claims. They talk to clients and send updates. They send reminders and quotes too. They collect documents and track compliance. They automate lead follow-ups and CRM work. This lets the agency focus on growing. Automation means less manual work and more done. Agencies can grow without hiring more people.

Scale Faster and Work Smarter with Insurance Virtual Assistants

Adapting to Business Growth

Mandarin-English bilingual insurance virtual assistants help insurance agencies grow without hiring more people. They do jobs like policy management, claims help, and lead generation. This lets agents spend more time selling insurance and talking to clients. Agencies can get more or less help when they need it. This is good when business is busy or slow.

- Virtual assistants work in different time zones, so clients get help anytime.

- They handle renewals, documents, and quotes fast, so work goes smoothly.

- Agencies do not pay extra for office space or equipment.

- Virtual assistants use safe systems and follow rules to keep client data safe.

Productivity Tracking

Insurance agencies work better, save money, and build strong client bonds with Mandarin-English bilingual insurance virtual assistants.

In a fast-paced insurance business, tracking team productivity is essential to maintain service quality and meet client expectations. Insurance virtual assistants can help streamline operations by handling time-consuming administrative tasks — but it’s equally important to monitor their performance.

With the right productivity tracking tools and daily reporting systems in place, agencies can easily review task completion rates, client response times, and follow-up records. Many remote service providers, such as Callnovo, offer integrated tracking solutions to ensure every bilingual virtual assistant’s work is visible, measurable, and aligned with business goals. This not only improves accountability but also helps agencies scale faster and optimize their workflow.

Case Study: How an Insurance Agency Boosted Productivity with Virtual Assistants

A mid-sized insurance agency based in California struggled with managing policy renewals, client follow-ups, and daily admin tasks. The in-house team was overwhelmed, and customer response times were slipping.

They brought on two Mandarin-English bilingual insurance virtual assistants through Callnovo, trained specifically in policy data entry, quote requests, and customer inquiry management.

Within 60 days, customer response times improved by 35%, policy update backlogs cleared, and the in-house agents gained an extra 4 hours per week to focus on new business. The agency saved over $2,000 monthly in admin costs while improving client satisfaction scores.

Ready to Experience the Power of Insurance Virtual Assistants?

In a fast-paced, client-driven industry like insurance, having the right support makes all the difference. From reducing administrative pressure to improving response times and enhancing client experiences, insurance virtual assistants bring powerful, measurable advantages to growing agencies.

As more businesses turn to this scalable solution, partnering with an experienced provider is key. Callnovo offers multilingual insurance virtual assistant services designed to fit the unique needs of your agency and help you stay competitive.

See how their tailored insurance VA solutions can benefit your business here:

https://callnovo.com/callnovo-multilingual-remote-virtual-assistant/

Or request a free, personalized quote today:

https://callnovo.com/request-a-quote/