Table of Contents

A Loan Processor helps a Loan Company operate more efficiently by managing mortgage and loan applications from start to finish. They verify documents like credit reports, income statements, and appraisals, reducing errors that could delay approvals. Certification programs teach processors specialized skills in mortgage lending, while ongoing education keeps them updated on new rules and technology. With trained and certified Loan Processors, a Loan Company can speed up loan approvals, maintain compliance, and provide a smoother experience for borrowers.

Improving Efficiency in Loan Processing

Managing Applications

A Loan Processor helps a Loan Company handle multiple loan applications efficiently. They use smart software and automation to work faster. This means less typing by hand, so there are fewer mistakes. It also helps stop delays. Some problems a loan processor can fix are:

- Mistakes from typing information by hand

- Slow work because many departments check things

- Long time spent checking loans by hand

- Trouble following all the rules

- Risk checks that are not always the same

Document Verification

A Loan Processor reviews every document to ensure it is accurate and complete. They use automated systems that can extract data with over 99% accuracy, reducing errors and speeding up loan approvals. These skills are developed through specialized training programs that teach processors how to handle mortgage applications efficiently, follow compliance rules, and use the latest loan management technology.

Coordination with Lenders

A Loan Processor works closely with lenders to keep the loan process on track. They prepare files, coordinate with different departments, and provide regular updates to ensure each step moves smoothly. This helps loans get approved faster and reduces bottlenecks.

By managing workflows efficiently and catching errors early, a Loan Processor enables a Loan Company to handle more loans with fewer mistakes, saving time and money while improving overall operations.

Enhancing Communication Between Teams

Coordinating Between Loan Officers and Underwriters

A certified Loan Processor helps connect loan officers, underwriters, and other team members. They gather and review loan applications, verify borrower information, and order necessary documents to ensure everything is accurate and complete. They also communicate with borrowers when additional information is needed, follow compliance rules, and update loan software systems.

Centralizing Client Communications

Centralizing client communications allows a Loan Company to respond to questions faster and provide better customer service. A certified Loan Processor uses tools to track every message, ensuring nothing is missed. This speeds up the workflow, helps loans get approved sooner, and keeps borrowers informed with timely updates. Clear and consistent communication reduces stress for clients and builds trust in the Loan Company.

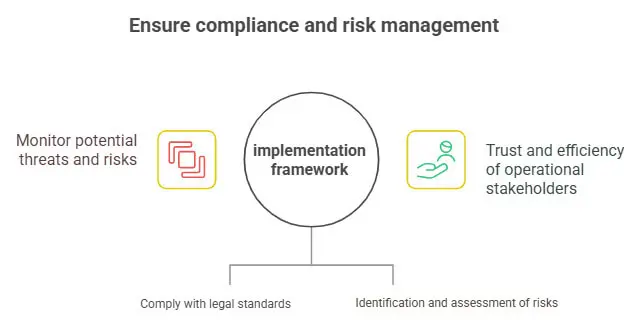

Ensuring Compliance and Risk Management

Maintaining Regulatory Documentation

A Loan Processor helps a Loan Company stay compliant with regulations by collecting all required documents using standardized checklists, ensuring nothing is missed. Centralizing requests in a single portal simplifies the process for both clients and staff, while real-time tracking allows the processor to quickly identify missing items. Detailed notes from meetings keep everyone aligned on requirements, and certified processors also monitor and update record-keeping practices to maintain compliance with current rules. Ongoing training and certification keep Loan Processors informed about new laws and regulatory changes, ensuring the mortgage process remains accurate, efficient, and fully compliant.

Monitoring Credit and Financial Risk

Certified Loan Processors, including master and contract processors, use financial tools to assess whether borrowers can repay loans and leverage machine learning to predict potential payment risks. They stay up-to-date on new regulations and emerging risks through ongoing training and certification, ensuring the mortgage process remains accurate and compliant. By using technology to monitor compliance and maintain records, certified Loan Processors help a Loan Company reduce penalties and stay audit-ready.

A strong compliance program has these steps:

- Find and check risks

- Lower and watch risks

- Report on compliance work

- Train staff often

Conclusion

With certified Loan Processors, your Loan Company can speed up approvals, reduce errors, and stay fully compliant. By leveraging workflow automation, real-time tracking, and expert coordination, loans move smoothly from application to closing. Let Callnovo provide experienced, certified processors who help your team work smarter, handle more loans efficiently, and deliver a better borrower experience—saving time, reducing risk, and boosting your company’s growth.

Company Name: Callnovo Inc.

Contact Person: Anita Lee

Email: anita.lee@callnovo.com.cn

Website: www.callnovo.com

Country: Canada

City: Toronto

Explore the benefits of Loan Processor outsourcing:

https://callnovo.com/callnovo-multilingual-remote-virtual-assistant/

Ready to get a customized quote?

Click here: https://callnovo.com/request-a-quote/