Table of Contents

Virtual assistants have become a critical resource for modern insurance brokers. For U.S. insurance brokers handling high volumes of client inquiries, policy renewals, and administrative paperwork, a virtual assistant provides a way to manage these tasks efficiently without the cost or commitment of hiring in-house staff. Many brokers struggle with overflowing inboxes, missed follow-ups, and repetitive data entry that distracts them from revenue-generating activities. Callnovo offers skilled assistants who can take on essential administrative responsibilities, allowing brokers to focus on high-value client interactions and business growth. By leveraging this support, insurance brokers reduce overhead, maintain service quality, and improve client satisfaction, all while freeing themselves from routine administrative work.

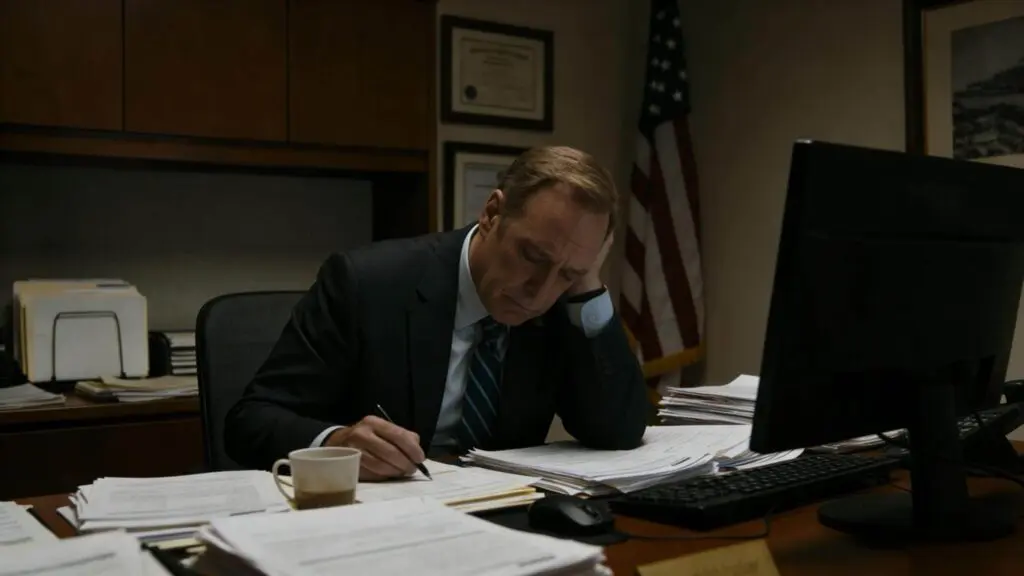

Why Administrative Work Slows Down Insurance Brokers

Brokers Are Pulled Away from Revenue-Generating Work

Insurance brokers often spend hours on routine administrative tasks such as updating client records, processing forms, and following up on emails and calls. These necessary duties consume time that could otherwise be spent on client consultations, policy recommendations, and business development. Virtual assistants can handle these tasks efficiently, allowing brokers to focus on activities that generate revenue and strengthen client relationships.

Slow Responses Hurt Client Experience and Retention

Delays in responding to client inquiries or managing policy renewals can reduce customer satisfaction and lead to missed opportunities. They monitor communications across emails, phone calls, and CRM notifications to ensure prompt, professional responses. By handling these routine interactions, brokers maintain high service standards without personally managing every detail, which enhances client trust and retention.

Fixed In-House Staffing Limits Flexibility

Maintaining full-time administrative staff is costly and inflexible, especially during seasonal spikes in workload. Assistants provide scalable support, allowing brokers to add resources during busy periods and reduce them during slower months. This flexibility lowers overhead, prevents burnout, and ensures consistent operational efficiency, keeping brokers’ businesses responsive and clients satisfied.

Top Administrative Tasks Insurance Brokers Should Outsource

Client Intake, Data Entry, and CRM Updates

Managing client intake and entering data into CRM systems consumes significant time daily. They collect client information, verify its accuracy, and maintain organized records. This ensures that brokers always have up-to-date information for consultations and follow-ups. By handling these routine tasks, virtual assistants allow brokers to focus on advisory work and strategic planning rather than repetitive administrative duties.

Quotes, Follow-Ups, and Policy Renewals

Processing quote requests, tracking pending applications, and managing policy renewals are repetitive but essential tasks. Virtual assistants track outstanding requests, send reminders, and ensure all documentation is complete. This reduces missed opportunities and prevents lapses in client coverage. By taking responsibility for these tasks, they free brokers to engage in higher-value work, such as client consultations and portfolio growth.

Document Handling and Routine Communications

Preparing forms, filing applications, and responding to standard client inquiries take time and attention to detail. They manage these responsibilities efficiently, keeping files organized and preventing errors or missed communications. With virtual assistants handling these essential but repetitive tasks, brokers can focus on complex decisions and client-facing activities, improving productivity and service quality simultaneously.

The Business Value of Virtual Administrative Assistants

Faster Responses Without Longer Working Hours

Virtual assistants enable brokers to respond quickly to client inquiries without extending their work hours. This ensures high service levels and improves client satisfaction. Brokers can maintain responsiveness, even during busy periods, without sacrificing their focus on revenue-generating activities.

Scalable Support Without the Cost of Local Hiring

Hiring in-house staff for administrative support can be costly. They provide an affordable alternative, offering on-demand support that scales with the broker’s workflow. During peak periods, virtual assistants handle additional tasks efficiently, while during slower months, brokers avoid paying for idle staff. This cost-effective model optimizes operational efficiency while keeping overhead low.

More Focus on Sales, Advisory, and Growth

By delegating administrative responsibilities to virtual assistants, brokers gain more time to focus on sales, client consultations, and business development. They act as strategic partners, not just cost-saving resources, helping brokers maximize revenue potential, strengthen client relationships, and expand their business portfolio.

A Smarter Outsourcing Model for U.S. Insurance Brokers

Assistants Who Understand Daily Insurance Operations

Virtual assistants integrate quickly into brokers’ workflows, handling forms, communications, and CRM updates efficiently. Brokers can trust that essential tasks are completed accurately without constant supervision, freeing them to focus on strategic and client-facing activities. With industry-trained assistants, Callnovo ensures that every administrative task supports growth and client satisfaction.

Transparent Systems That Keep Work Organized and Trackable

Callnovo equips its assistants with systems that provide full visibility into task progress and accountability. Brokers can monitor workflows and track task completion, ensuring that administrative responsibilities are handled efficiently while staying informed of ongoing operations. This transparency allows brokers to maintain control without getting bogged down in routine work.

Flexible Support That Adjusts to Workload Demands

They provide scalable, adaptive support to manage surges in client inquiries or high-volume administrative tasks. Whether it’s handling renewals, quote follow-ups, or routine communications, Callnovo’s virtual assistants adjust seamlessly to meet operational needs, ensuring continuous efficiency and consistent client service. This flexibility helps brokers scale support as their business grows without increasing overhead.

Conclusion

By choosing Callnovo, insurance brokers gain access to skilled virtual assistants who streamline administrative tasks, improve client responsiveness, and reduce operational costs. With scalable support, industry expertise, and transparent systems, brokers can focus on growth and client engagement while ensuring efficiency and high-quality service. Callnovo makes outsourcing seamless, reliable, and tailored to every broker’s needs.

Ready to reclaim your time? Connect with Callnovo today and empower your business with expert virtual assistants handling your administrative tasks.

Company Name: Callnovo Inc.

Contact Person: Anita Lee

Email: anita.lee@callnovo.com.cn

Website: www.callnovo.com

Country: Canada

City: Toronto

Explore the benefits of remote Mandarin-speaking assistant outsourcing:

https://callnovo.com/callnovo-multilingual-remote-virtual-assistant/

Ready to get a customized quote?

Click here: https://callnovo.com/request-a-quote/