Table of Contents

Virtual assistants are becoming essential as mortgage brokers face nonstop paperwork, borrower follow-ups, and pipeline updates. Many brokers spend a large portion of their day on manual tasks instead of advising clients or closing loans. This ongoing workload often leads to long hours, rising stress, and a higher chance of mistakes—issues reported across many workplace studies. They over repetitive admin work—document intake, scheduling, status checks, and communication—so brokers can stay organized and avoid falling behind. With consistent support, mortgage professionals gain more time, better focus, and a smoother path to growth.

Key Daily Tasks That Support Mortgage Brokers

Document Intake and Pre-Processing for Borrowers

An assistant helps mortgage brokers manage the steady flow of borrower documents by collecting, naming, and organizing files as they come in. They review submissions for completeness, flag missing items, and ensure each file is placed in the correct folder or LOS/CRM category. This early-stage pre-processing reduces delays later in the loan cycle and keeps brokers from spending hours sorting through email attachments.

Conditions Tracking and Follow-Up with Borrowers and Realtors

Virtual assistants keep loan conditions on track for brokers. They manage document verification and coordinate with borrowers and realtors. This support ensures all paperwork stays accurate and up-to-date. Assistants use mortgage CRM software to monitor loan statuses and send reminders about deadlines. They provide timely updates, which helps brokers stay organized and compliant.

Loan Pipeline Updates and Status Reporting

Mortgage brokers rely on virtual assistants to keep the loan pipeline moving. Assistants track loan applications and provide real-time status updates using mortgage CRM software. They handle client follow-ups, verify documents, and maintain compliance checklists. This approach helps brokers focus on high-value tasks and improves overall efficiency.

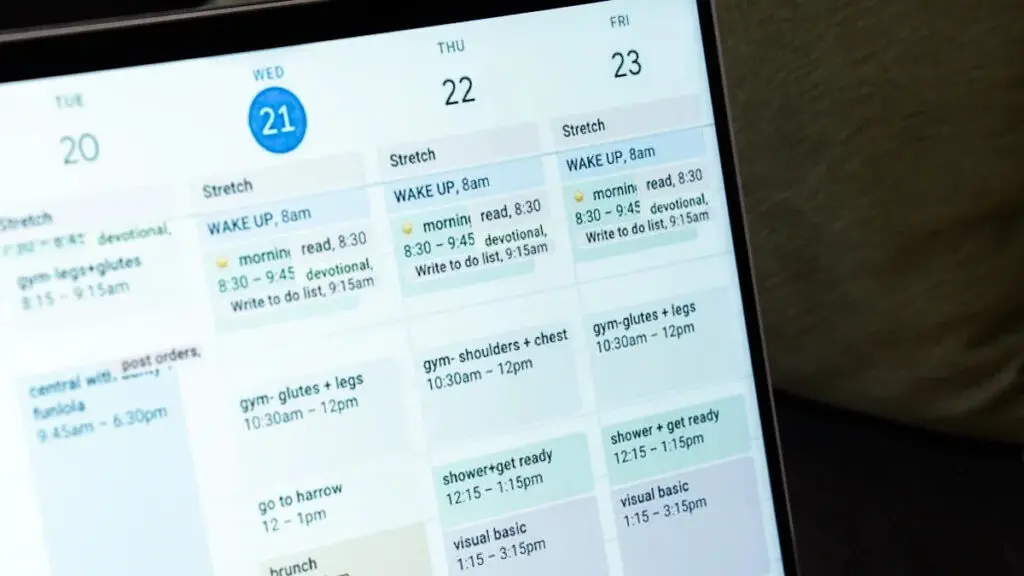

Scheduling, Email Management, and Client Communication Support

A virtual assistant manages scheduling, email, and client communication for mortgage brokers. They confirm appointments, send reminders, and coordinate meetings using mortgage CRM software. Assistants maintain regular contact with clients, loan officers, and realtors. They reply to emails quickly, make outbound calls, and provide updates about loan status. This support keeps everyone informed and reduces missed opportunities.

- Confirm appointments and send reminders

- Manage online booking systems

- Track daily schedules and meetings

- Proactively communicate loan status

- Set up and manage CRM systems

Virtual assistants help brokers handle daily tasks with ease. Their use of automation and mortgage CRM software improves accuracy, saves time, and keeps the mortgage process running smoothly.

How Dedicated Support Teams Improve Mortgage Workflow Efficiency

Reducing Turnaround Time Through Task Automation and Consistent Follow-Up

Virtual assistants help mortgage teams shorten turnaround times by taking on routine but time-sensitive tasks—such as collecting missing docs, confirming appraisal schedules, or requesting updated paystubs. Instead of brokers juggling dozens of follow-ups, the assistant maintains steady communication with borrowers, realtors, and third parties. This consistent outreach prevents delays, keeps files moving, and ensures conditions are cleared faster. As a result, loan files progress through underwriting and processing without unnecessary downtime.

Minimizing Errors with Standardized, Process-Driven Workflows

Mortgage files require accuracy at every step, from AUS findings to income documentation. Virtual assistants follow standardized checklists and process-driven workflows to ensure each file is complete and compliant before submission. They cross-check document names, verify formatting, and make sure disclosures or borrower uploads meet lender requirements. This reduces the risk of missing documents, incomplete packages, or errors that cause underwriter reconditions—ultimately improving loan quality and reducing back-and-forth.

Real-Time Task Visibility Through Dashboards and Progress Tracking

With support from workflow dashboards and status trackers, brokers gain full visibility into what the assistant is handling. Every follow-up, update, and task is logged, timestamped, and displayed in real time. This transparency makes it easier for brokers to prioritize files, plan their day, and quickly respond to client or realtor inquiries. Instead of guessing where things stand, the entire pipeline becomes clearer, faster to manage, and more predictable—helping mortgage teams operate with greater confidence and consistency.

Why Virtual Assistants Are a Reliable Support Option for Mortgage Brokers

Cost Savings Compared to Traditional In-House Admin Staff

Callnovo’s virtual assistants give mortgage brokers a dependable way to cut operational costs while maintaining high-quality support. Instead of paying full-time salaries, benefits, and office expenses, brokers can access experienced administrative help at a much lower cost. This allows growing mortgage teams to scale efficiently and manage workloads without stretching their budget.

Multi-Time-Zone Coverage for Faster Response and Client Updates

With multi–time-zone coverage, Callnovo’s assistants provide extended availability that in-house teams often can’t offer. They handle document confirmations, borrower follow-ups, and realtor updates earlier or later in the day, helping files move forward without delay. This responsiveness improves borrower satisfaction and gives brokers a competitive edge.

Secure, Monitored Systems to Protect Borrower Data and Compliance

Security is a top concern for mortgage brokers. Virtual assistants use strong cybe Callnovo’s assistant team works inside secure, monitored systems designed to protect borrower data. Access controls, audit trails, and compliance-focused workflows ensure every task is completed safely and transparently. This structure helps brokers stay aligned with industry regulations and reduces the risk of data or process errors.

Ready to streamline your mortgage operations? Discover how Callnovo’s virtual assistants can support your workflow—reach out today for a customized plan.

Company Name: Callnovo Inc.

Contact Person: Anita Lee

Email: anita.lee@callnovo.com.cn

Website: www.callnovo.com

Country: Canada

City: Toronto

Explore the benefits of remote Mandarin-speaking assistant outsourcing:

https://callnovo.com/callnovo-multilingual-remote-virtual-assistant/

Ready to get a customized quote?

Click here: https://callnovo.com/request-a-quote/