As we move into 2025, virtual assistants for financial services are reshaping the banking and fintech sectors, driving efficiencies, improving customer service, and ensuring regulatory compliance. Financial institutions are experiencing significant gains, with virtual assistants increasing operational efficiency by 25% and customer satisfaction by 27%. In this article, we explore how virtual assistants are revolutionizing the industry, focusing on customer experience, operational efficiency, and regulatory compliance.

Key Takeaways

- Enhanced Customer Satisfaction: Virtual assistants for financial services provide personalized advice, manage loyalty programs, and offer 24/7 support, boosting customer satisfaction by 27%.

- Increased Operational Efficiency: By automating routine tasks and minimizing errors, virtual assistants improve productivity, resulting in a 25% increase in operational efficiency.

- Ensuring Compliance and Security: Callnovo ensures strict GDPR and COPC compliance through its human-powered virtual assistants for financial services, protecting sensitive customer data.

Transforming Customer Experience with Virtual Assistants

In today’s competitive financial services industry, customers expect personalized, immediate support. Virtual assistants help banks meet this demand by providing real-time account updates, tailored financial advice, and seamless service integration.

By offering round-the-clock support and personalized services, full-time virtual assistants for financial services significantly boost customer satisfaction and loyalty for financial institutions.

Boosting Customer Loyalty

Virtual assistants help banks drive customer loyalty programs by analyzing transaction data and engagement trends, offering personalized rewards, cashback, and exclusive offers. This keeps customers engaged and strengthens long-term relationships.

24/7 Support

Round-the-clock availability is a key differentiator for virtual assistants in banking. By offering immediate support for lost cards, payment issues, or account queries, virtual assistants enhance user experience while freeing up customer service teams for more complex tasks.

Operational Efficiency in Payments Industry

Virtual assistants help streamline payment processes, minimizing errors and improving accuracy. With continuous operation, financial transactions are processed swiftly, optimizing the management of day-to-day banking operations.

Whether part-time virtual assistants or full-time virtual assistants, they can effectively improve the operational efficiency of banks and financial services, helping institutions reduce labor costs and increase productivity.

Fraud Detection and Prevention

By analyzing transaction patterns and customer behavior, virtual assistants identify fraudulent activity, alerting customers to potential threats in real-time and reducing investigative workloads by 20%.

Ensuring Compliance in Banking

Virtual assistants also play a crucial role in ensuring regulatory compliance. They monitor transactions, detect suspicious activity, and provide real-time updates to financial institutions, helping them stay ahead of regulatory requirements.

Part-time virtual assistants also play an important role in ensuring compliance in financial services, as they can monitor and report customer data in real-time, helping financial institutions meet stringent regulatory requirements.

How Herodash SAAS and SSM Screenshot Software Enhance Operations

At Callnovo, we offer more than just virtual assistants. Our Herodash SAAS platform optimizes customer service operations by analyzing performance metrics and workflow optimization, while SSM Screenshot Software ensures compliance and transparency by capturing real-time screenshots of interactions.

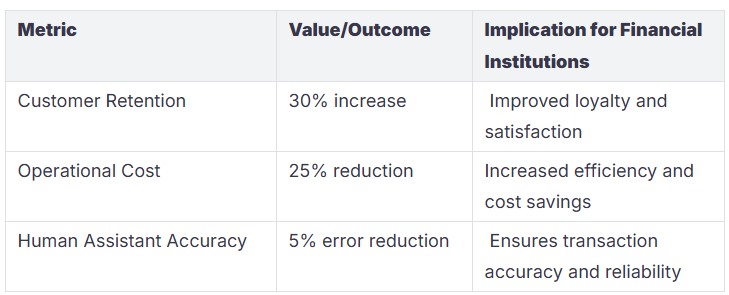

Successful Case: Bank ABC

Bank ABC leveraged our virtual assistant services along with Herodash and SSM Screenshot Software. This integration resulted in a 30% increase in customer retention and a 25% reduction in operational costs within the first six months.

In the successful case, Bank ABC implemented full-time virtual assistants, resulting in a 30% increase in customer retention and a 25% reduction in operational costs within the first six months.

Key Metrics and Results

Conclusion: The Future of Virtual Assistants in Financial Services

Virtual assistants are transforming financial services by improving operational efficiency, boosting customer satisfaction, and ensuring compliance with industry regulations. With the integration of Herodash SAAS for performance tracking and SSM Screenshot Software for monitoring, financial institutions can continuously improve customer service and drive business growth.

At Callnovo, we ensure all customer data complies with GDPR standards and follows COPC industry best practices. Contact us today for a consultation and learn how virtual assistants can revolutionize your customer service operations.