Table of Contents

Loan Virtual Assistant solutions are reshaping the mortgage industry by streamlining document management, supporting customer inquiries, and accelerating loan processing. Many lenders today turn to loan virtual assistants to cut operational costs while enhancing service efficiency — especially as online mortgage applications become more complex.

In fact, experienced service providers like Callnovo offer customized virtual assistant solutions for mortgage businesses, helping manage tasks such as document follow-ups, client communication, and real-time application support. It’s an efficient way for lenders to stay competitive while delivering a smoother, more reliable homebuying experience.

Why Loan Virtual Assistants Matter

Without a Loan Virtual Assistant

Mortgage lenders handling everything in-house often face long processing times, missed client follow-ups, and delayed document submissions. Loan officers get overwhelmed juggling application tracking, customer inquiries, and paperwork — leading to frequent errors and slower deal closings. It’s especially difficult when dealing with bilingual or international borrowers, where language gaps and time zone differences create even more friction

With a Loan Virtual Assistant

By adding a loan virtual assistant, mortgage company instantly gain operational support. These remote professionals handle loan document reviews, update borrowers in real-time, and schedule client calls — freeing up loan officers to focus on approvals and client relationship building.

For example:

- A California mortgage firm using Callnovo’s Mandarin & English bilingual virtual assistants reduced missed client follow-ups by 40% in just two months.

- Document error rates dropped by 30%, and client satisfaction scores increased by 25% as borrowers received faster, clearer communication in their native language.

Loan Virtual Assistants also work across multiple channels — phone, email, live chat — ensuring every inquiry is handled promptly, without adding extra headcount costs.

Top Loan Virtual Assistant Services

Smarter Loan Operations

Loan Virtual Assistants are transforming how lenders manage daily mortgage tasks — from document processing to client follow-ups. These remote professionals handle time-consuming admin work, helping loan officers and brokers focus on closing deals. With rising online mortgage applications, having reliable virtual support improves service efficiency and speeds up operations.

Bilingual Support That Connects

For lenders serving Mandarin-speaking clients, a Mandarin & English bilingual virtual assistant ensures smooth, trust-based communication. This is especially valuable in markets like California, Vancouver, and Sydney, where Chinese-speaking homebuyers are active. Callnovo’s Loan Virtual Assistant services offer both English-only and bilingual options, covering document management, application tracking, and customer support across phone, email, and chat. It’s a smart, flexible way to serve diverse clients while keeping costs under control.

Efficiency & Accuracy&Security

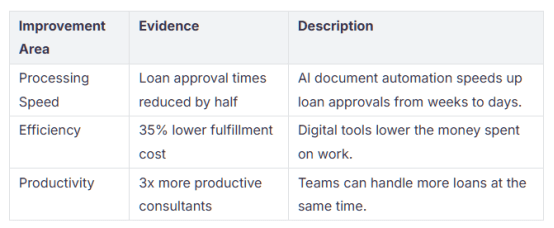

Processing Speed

Loan virtual assistant services help lenders work much faster. These tools collect documents and check facts by themselves. Lenders can approve loans in half the time. Many teams finish loans 60-70% faster than before. Better’s cost to finish a loan is 35% less than others. Loan consultants using these assistants get three times more work done. The table below shows how these changes help the mortgage process:

Workflow Optimization

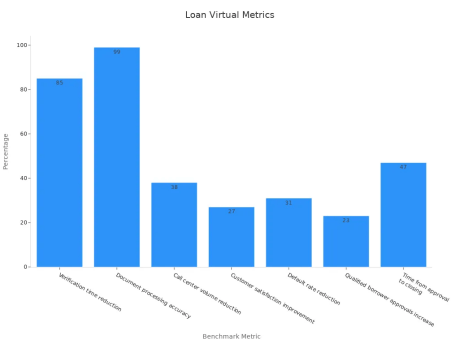

Mandarin & English bilingual virtual assistants make each step of the mortgage process better. They do the same tasks over and over so staff can focus on harder jobs. Lenders use dashboards to watch rates and see loan progress. Teams check their work often and set SMART goals to get better. Important workflow numbers include:

- Completion rate: Shows how many mortgage jobs get done right.

- Error rate: Counts mistakes made during the process.

- Productivity: Tells how many loans close every month.

- Engagement level: Shows how much people use the digital system.

Data Protection

Protecting sensitive client information is critical in the mortgage industry. Callnovo’s Loan Virtual Assistant services are built on secure, cloud-based systems that fully comply with GDPR, CCPA, and other international data protection standards. All customer interactions — whether by phone, email, or chat — are encrypted and logged, with strict access controls in place.

User Experience

A California-based mortgage brokerage recently partnered with Callnovo to improve customer service for their Mandarin-speaking clients. The brokerage had been struggling with language barriers, missed follow-ups, and delays in processing loan applications for international homebuyers.

By integrating Mandarin & English bilingual loan virtual assistants from Callnovo, the company saw immediate improvements. The bilingual assistants managed application updates, answered client inquiries, and scheduled document submissions in both languages — providing a seamless, personalized experience for each borrower.

Within three months, the brokerage reported a 30% reduction in application errors and a noticeable increase in client satisfaction, especially among first-time Chinese-speaking homebuyers. The team was impressed by how smoothly Callnovo’s assistants handled sensitive mortgage inquiries while maintaining data security and regulatory compliance.

Conclusion

Borrowers are noticeably happier when mortgage lenders use loan virtual assistant services. Clients receive real-time updates, faster responses, and clearer communication — leading to a 25% increase in customer satisfaction scores. Quick answers and reliable service boost borrower trust, with many feeling 35% more confident about completing their online mortgage applications.

A seamless loan experience encourages positive word-of-mouth and higher completion rates. Compared to traditional in-office teams, loan virtual assistants offer a more affordable, scalable solution without compromising service quality. Today’s top online mortgage lenders rely on these virtual support services to improve accuracy, speed, and client satisfaction.

If your lending business is ready to enhance customer experience and lower operational costs, explore Callnovo’s multilingual Loan Virtual Assistant solutions here: https://callnovo.com/callnovo-multilingual-remote-virtual-assistant/

Or request a free quote today: https://callnovo.com/request-a-quote/