Table of Contents

As the mortgage industry in North America continues to expand, more brokers are building dedicated teams to manage increasing workloads. However, with rising local labor costs and frequent staff turnover, virtual assistants have become a more flexible and cost-effective alternative to traditional in-house staff. This article explores three key advantages of working with a mortgage virtual assistant. For brokers seeking reliable bilingual support, services like those from Callnovo are an efficient and affordable option.

Who Should Hire a Mortgage Virtual Assistant?

Independent Mortgage Brokers

Independent mortgage brokers do many jobs at once. They talk to clients, fill out loan forms, and enter data. A Mortgage Virtual Assistant can help them save time. The bilingual assistant does simple tasks, so brokers feel less stress. This lets brokers spend more time with clients and close more deals. The KPMG study notes mortgage brokers must work faster and deliver steady service. Virtual assistants support this by handling inquiries 24/7 and managing simple tasks, while automation tools process documents and data. This helps brokers respond quickly and improve workflow efficiency.

Mortgage Companies and Lending Teams

Mortgage companies and lending teams manage high loan volumes while juggling borrower inquiries, compliance checks, and customer support. A Mandarin & English bilingual Mortgage Virtual Assistant can efficiently handle multiple client questions, document call notes, and perform compliance reviews. By taking on these diverse tasks, bilingual virtual assistants help teams increase productivity, reduce operational costs, and ensure consistent, compliant service — ultimately maximizing business profitability.

How Much Does It Cost to Hire a Bilingual Virtual Assistant?

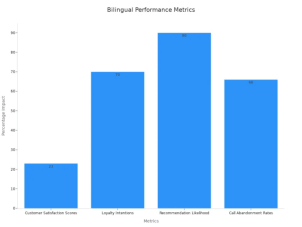

When you hire a bilingual virtual assistant in North America, you can help more clients. Many brokers and lenders want assistants who speak both English and Mandarin. This skill lets them talk to more people and get more loans done. The price for a bilingual mortgage virtual assistant depends on where they work and how much experience they have.

Value-Added Remote Services

- Cost Savings: Typically 40-60% less expensive than hiring local, in-house staff.

- Multitasking Support: Handles client calls and manages paperwork efficiently.

- Dedicated Client Success Manager: Ensures daily performance oversight and service quality.

- Team Coordination: Manages communication between virtual assistants and your internal team.

- Reliable Bilingual Assistance: Provides seamless support in both Mandarin and English.

- Reduced Management Burden: Removes the hassle of directly managing remote staff.

- Maximized Efficiency and Value: Improves operational workflow and boosts overall productivity.

Key Benefits of Using a Mortgage Virtual Assistant for Loan Brokers

Work Flexibly Across Time Zones

A Mortgage Virtual Assistant can work from any place. Many bilingual assistants help outside normal work hours. This lets brokers help clients in other time zones or answer late-night questions.

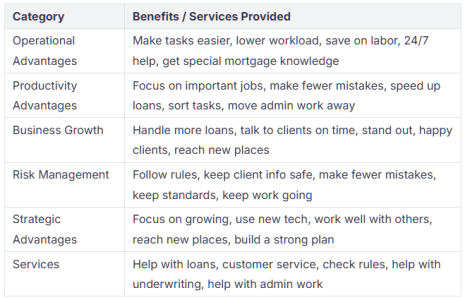

Some teams use assistants in other countries for 24/7 help. This makes it easy to answer questions fast and keep clients happy. The table below shows more ways a Mortgage Virtual Assistant helps with flexible work:

Boost Productivity and Focus on Closings

Loan brokers want to close more deals and do less paperwork. A Mortgage Virtual Assistant does simple jobs. This lets brokers spend more time talking to clients and finishing loans.

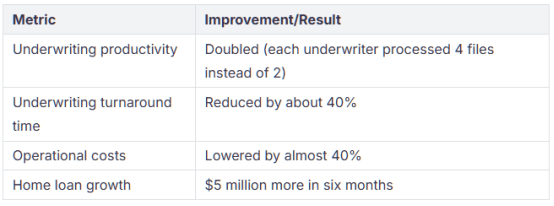

Studies say a Mandarin & English Bilingual Mortgage Virtual Assistant can double how much work underwriters do. Underwriters can finish four files instead of two. Time to finish work drops by 40%. Some brokers see home loans grow by $5 million in six months.

Ways a Mortgage Virtual Assistant Supports Your Mortgage Business

Loan Documentation

Mortgage Virtual Assistants keep loan papers neat and in order. They gather, sort, and check papers to see if anything is missing. This makes loans go faster and helps stop mistakes. Lenders use safe online tools to keep files safe and easy to find. When assistants do these jobs, brokers do not have to wait and clients stay happy.

Data Entry

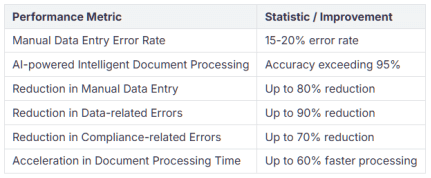

Getting data right is very important in mortgage work. Mortgage Virtual Assistants type in info from loan forms, credit checks, and bank papers. They use smart computer programs to make fewer mistakes and work faster.

Client Communication

Mortgage Virtual Assistants make it easy for brokers to stay connected with their clients. They promptly answer questions, share important updates, and gently remind clients about any missing documents. Using chatbots and email, they provide quick, friendly responses—even outside regular business hours—so clients always feel supported.

Bilingual Support

Many people in North America speak more than one language. Mandarin & English Bilingual Mortgage Virtual Assistants who speak two languages help more clients. They answer questions, explain papers, and set up meetings in the client’s language.

Conclusion

In today’s competitive mortgage industry, managing increasing workloads efficiently is crucial for success. Mortgage virtual assistants, especially bilingual ones skilled in Mandarin and English, offer valuable support by handling administrative tasks, ensuring compliance, and maintaining seamless client communication. By leveraging these professionals, loan brokers can save time, reduce costs, and focus more on closing deals. For mortgage professionals seeking reliable and cost-effective virtual assistant services, Callnovo provides expert bilingual support tailored to your business needs, helping you streamline operations and grow your business with confidence.

Ready to simplify your workflow and reduce costs? Request a free quote today: https://callnovo.com/request-a-quote/

Learn more here: https://callnovo.com/callnovo-multilingual-remote-virtual-assistant/