In the face of a global economic & geopolitical climate as volatile as the weather, the travel insurance industry confronts unparalleled challenges.

Market fluctuations shake customer confidence, highlighting the critical role of robust customer service outsourcing.

Recent statistics reveal: there’s a 25% hike in policy adjustments due to shifting travel advisories, while a survey shows 75% of travelers now insist on more adaptable insurance for global travel options.

Integral to this approach is business continuity planning, ensuring global insurance services withstand disruptions.

The implementation of offshore customer service for travel insurance is not solely about survival – it’s about thriving.

Global insurance companies – such are yours – can enhance the insurance for global travel customer experience, cementing customer engagement solutions; this marks a strategic pivot towards resilience & enduring success.

The Role of Offshoring in Navigating Volatility for the Travel Insurance Industry

In the dynamic arena of global commerce, even while the insurance for global travel sector finds itself at the mercy of fluctuating economic and geopolitical climates, offshoring emerges as a strategic tool.

Offshoring offers a beacon of stability enabling global insurance businesses, such as yours, to maintain a consistent level of service despite such challenges.

Offshoring is a testament to the adaptability & forward-thinking approaches that characterize the modern travel industry.

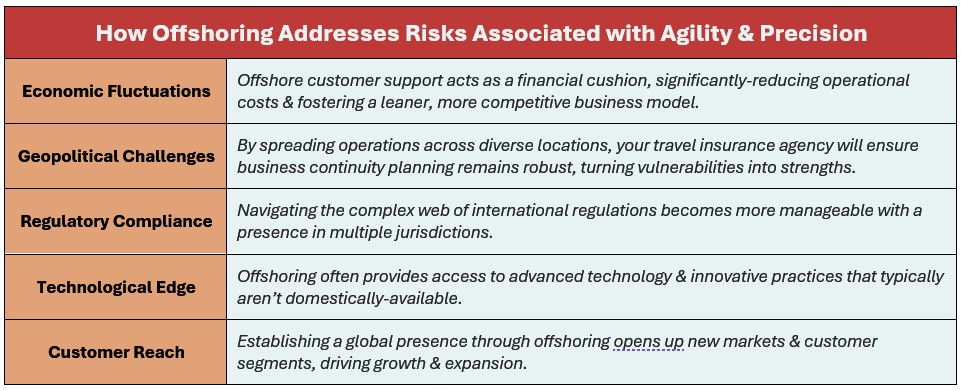

Offshoring as a Risk Mitigation Tool

Offshoring serves as a multi-faceted instrument in the insurance for global travel sector’s toolkit, addressing various risks with agility & precision.

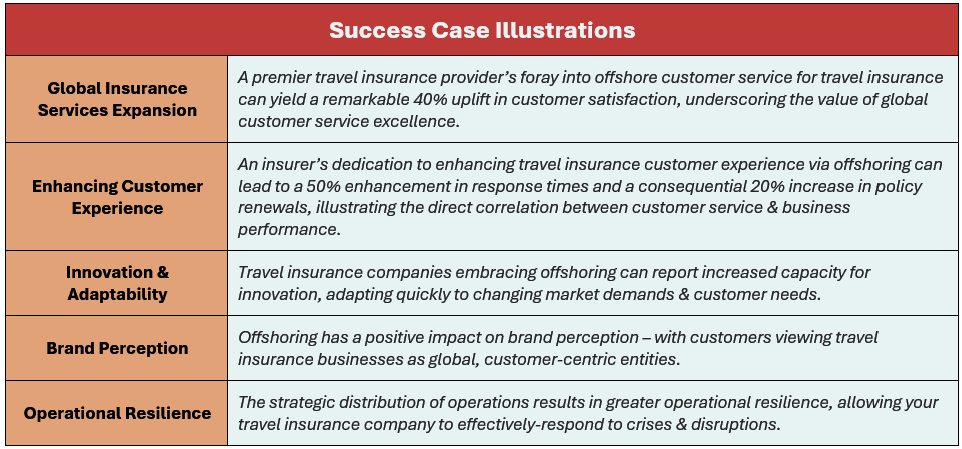

Premium Success Cases

The success stories of offshoring in the travel insurance industry are both compelling & instructive, highlighting the tangible advantages of this strategic approach.

These case studies underscore the effectiveness of insurance for global travel business resilience strategies that incorporate offshoring.

By implementing offshore support in insurance, your travel insurance conglomerate will both survive – and set new benchmarks in insurance for global travel customer engagement solutions.

The next section will explore best practices for implementing these offshore strategies, ensuring a seamless transition, maximizing benefits for both your agency – and its valued customers.

Let’s focus on creating a sustainable, resilient operational model aligning with the long-term vision of the travel insurance industry.

Best Practices for Implementing Offshore Strategies

In the intricate dance of global business within the insurance for global travel sector, offshoring is a strategic choreography demanding precision & grace.

It’s about creating a symphony of services resonating across borders, ensuring every note aligns with the overarching melody of your travel insurance conglomerate’s mission & vision.

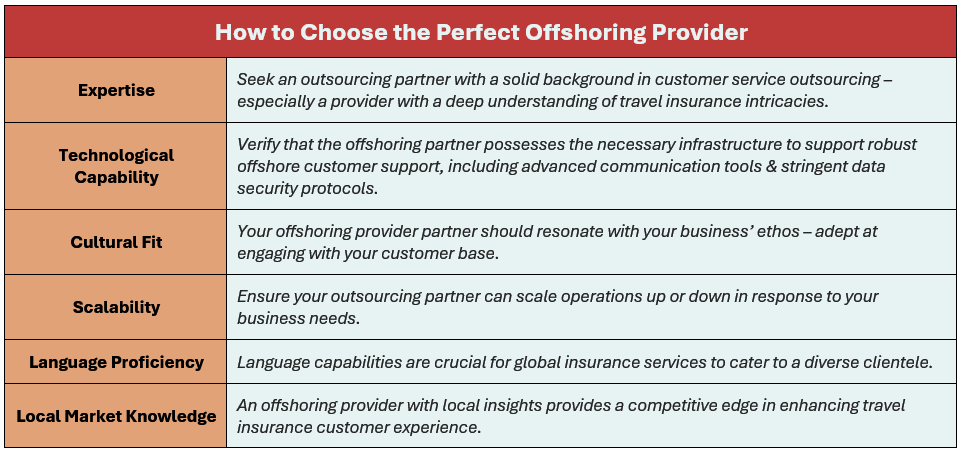

Selecting the Ideal Offshore Partner

Choosing the right offshoring provider is akin to finding a dance partner who moves in sync with you.

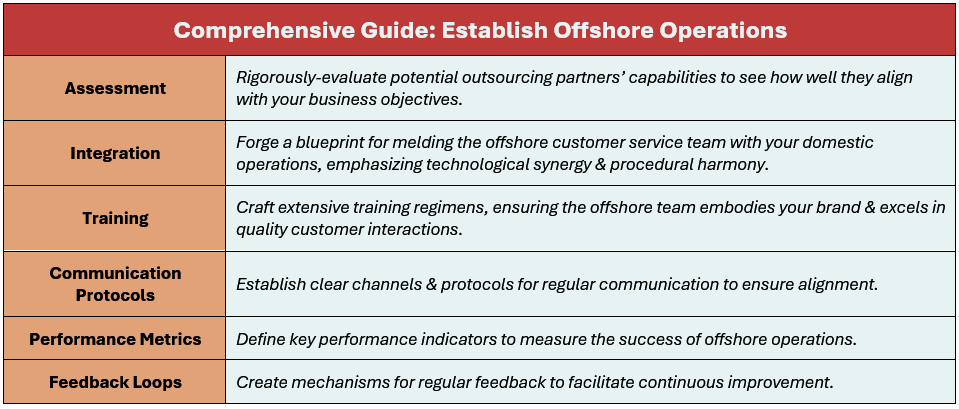

Step-by-Step Guide to Establishing Offshore Operations

Embarking on the offshoring journey requires a roadmap navigating through the complexities of cross-border operations.

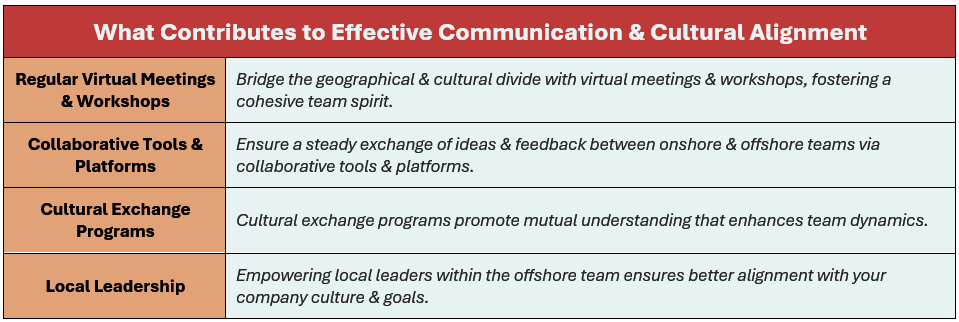

Maintaining Effective Communication & Cultural Alignment

Harmonious communication & cultural congruence are the linchpins of successful offshoring.

By embracing these best practices, your insurance for global travel company will refine its customer experience & construct robust planning of business continuity.

The objective here is the following: to cultivate an offshore extension that mirrors your business’ quality – and personifies your brand’s core principles.

This strategic methodology in implementing offshore support in insurance not only shields against market fluctuations – but, it also propels your agency towards enduring growth & prosperity.

Maintaining Service Quality & Business Continuity

In the ever-evolving landscape of travel insurance, maintaining the integrity of services is paramount.

By expanding through customer support outsourcing, your insurance company will ensure the consistency of service quality & robust business continuity planning that will become the cornerstone of trust & reliability in the eyes of your global customers.

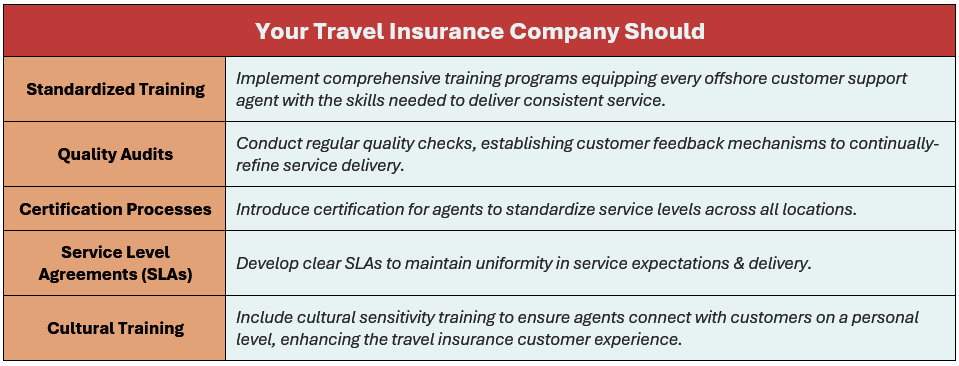

Uniform Service Standards Across Locations

To uphold the highest standards of service…

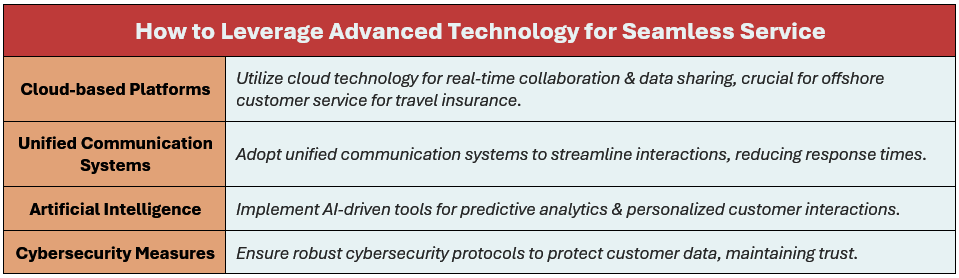

Advanced Technology for Seamless Integration

Leveraging technology is key to integrating operations & providing seamless service.

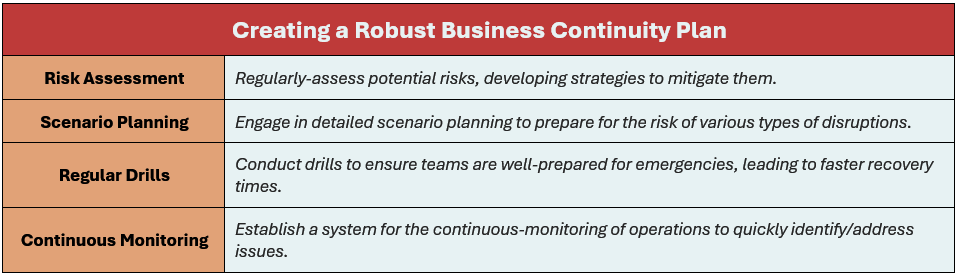

Robust Business Continuity Plans

A solid business continuity plan is essential for insurance for global travel companies to navigate unforeseen events.

By focusing on these key areas, your global travel insurance agency will enhance its customer experience, cementing its reputation & customer loyalty.

This dedication to quality & continuity is a commitment to your customers, assuring them of steadfast support.

Next, we’ll explore how Callnovo Contact Center embodies these principles, setting a high standard in insurance for global travel business resilience strategies, implementing offshore support in insurance for unmatched travel insurance customer engagement solutions.

Callnovo Contact Center’s Approach to Offshoring (Customer Service Outsourcing)

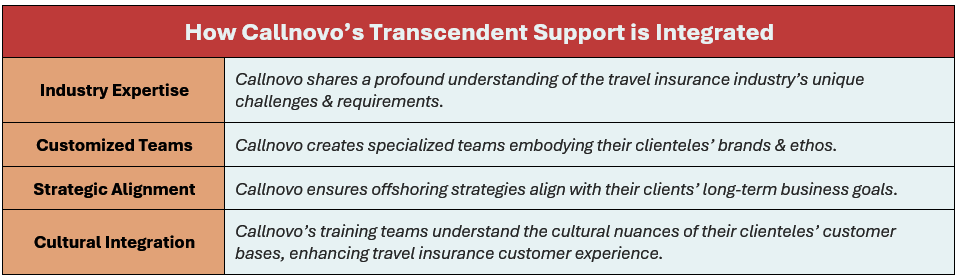

In the intricate web of global commerce, Callnovo Contact Center stands out.

Callnovo’s tailored approach to offshoring within the travel insurance sector – as well as its commitment to service excellence – shines through its custom offshoring solutions that are meticulously-crafted to meet the nuanced needs of your insurance for global travel provider.

Tailored Offshoring Services

Callnovo’s offshore customer support transcends traditional boundaries, becoming an integral part of the travel insurance companies it collaborates with.

High-quality Customer Service Solutions

At the heart of Callnovo’s offshoring services lies an unwavering commitment to quality, characterized by:

- Rigorous Training: Callnovo’s comprehensive training programs equip CSRs with the skills needed to deliver exceptional service.

- Performance Monitoring: Callnovo’s continuous evaluation of service delivery significantly-improves quality standards.

- Feedback Integration: Callnovo incorporates customer feedback to correctly refine & enhance service offerings.

- Technological Support: Utilizing cutting-edge technology, Callnovo facilitates superior customer interactions & insurance for global travel customer engagement solutions.

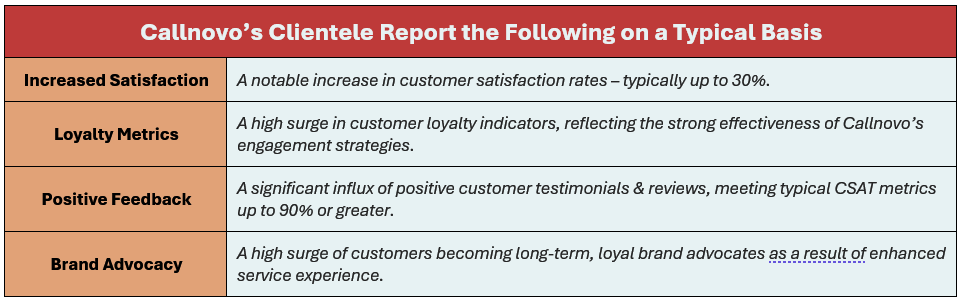

Enhancing Customer Experience & Loyalty

Callnovo’s influence on enhancing travel insurance customer experience is significant & measurable.

A Great Impact

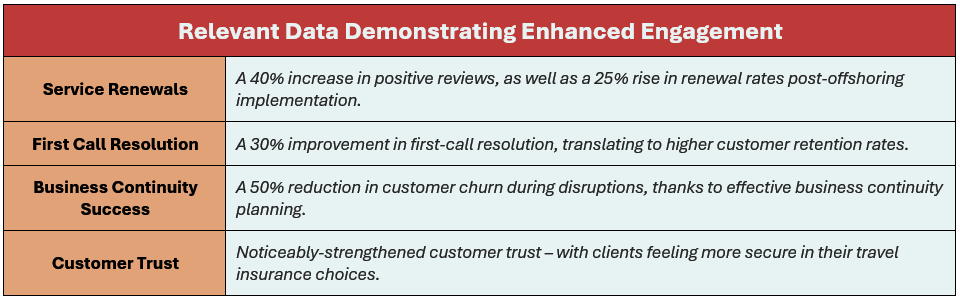

Callnovo’s focus on insurance for global travel business resilience strategies has enabled global insurance companies to adeptly-navigate global market complexities; this is evidenced by:

- Policy Renewals: Naturally, Callnovo’s clientele notice a 25% improvement in policy renewals post-transition to its provided offshoring services.

- Market Adaptability: Clients notice an enhanced ability to adapt to market changes & customer needs.

- Operational Efficiency: Callnovo supports the streamlining of operations – which lead to cost savings up to 60%, as well as improved service delivery.

- Strategic Growth: Callnovo assists its clients in achieving strategic growth, significantly-expanding their global footprint.

In conclusion, Callnovo Contact Center is a paragon of how strategic offshoring transforms customer service in the travel insurance sector.

With their dedicated approach, Callnovo not only elevates customer experience – but cultivates lasting loyalty – propelling the success & expansion of insurance for global travel businesses across the globe.

The Impact of Offshoring on Customer Engagement & Loyalty

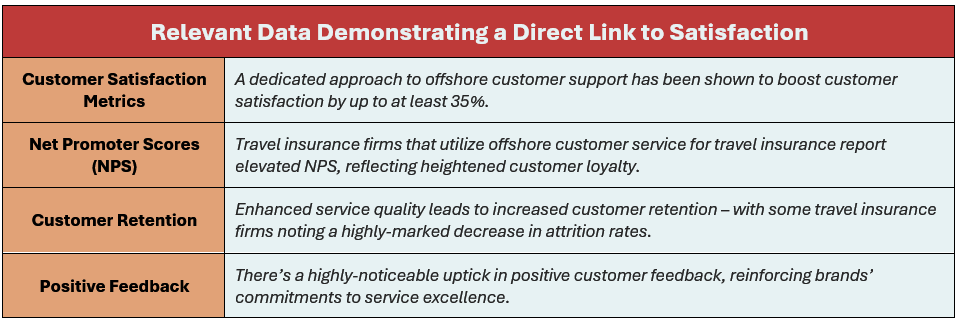

The strategic deployment of offshoring in the travel insurance sector has transcended its original cost-saving premise to become a pivotal element of customer-centric growth.

This shift translates to the optimizing of resources, as well as the reimagining of how insurance for global travel services are delivered, fostering deeper customer connections & loyalty.

Direct Link to Customer Satisfaction

These instances highlight the profound impact of travel insurance business resilience strategies that integrate offshoring.

By implementing offshore support in insurance, your insurance for global travel firm will not merely sustain operations – but will elevate the travel insurance customer experience, solidifying enduring loyalty.

In conclusion, offshoring emerges as a strategic facilitator for insurance for global travel customer engagement solutions, nurturing a loyal customer base essential for ongoing business prosperity.

Compelling statistics & premium case examples pave the way for offshoring to act as a transformative force within the customer service domain.

Conclusion

In the dynamic realm of global insurance services, offshoring has emerged as a linchpin for travel insurance firms, such as your own, bolstering them against the capricious waves of international markets.

The strategic infusion of customer support outsourcing into offshore locales, as a highlighted tactic & transformative maneuver, enhances insurance for global travel customer experience, ensuring operational tenacity & upholding a staunch dedication to excellence.

This paradigm shift is not just about resilience – but redefining strategies for travel insurance business resilience to confidently navigate through uncertainties.

The implementation of offshore customer support equips your insurance for global travel business with a competitive advantage, keeping the planning of business continuity & travel insurance customer engagement solutions in sharp focus.