The Fintech sector has undergone a remarkable transformation – evolving from just a niche market to a dominant force in the global financial landscape.

With a projected user base exceeding 3.5 billion by 2024 (according to a Statista report), the industry’s growth is not just impressive – it’s exponential.

This surge is mirrored in the escalating demand for superior customer experience (CX), particularly in digital banking & payment systems.

At the heart of this customer service revolution are English-speaking representatives – pivotal in delivering Fintech solutions to a diverse, global audience.

English-speaking reps’ role in enhancing Fintech CX is crucial, ensuring financial services are accessible, efficient, and culturally-attuned.

As we explore the strategic advantages & challenges of offshoring, we’ll delve into how it can bolster Fintech customer service technology, leading to significant Fintech payment system improvements.

It’s not without its hurdles; the intricacies of managing a global workforce – including ensuring multilingual Fintech support services – present unique challenges to be navigated with care. Let’s go through a guide on the labyrinth of offshoring, providing insights into how Fintech companies – like your own – can…

Strategic Advantages: Fintech Solutions

In the dynamic world of finance, Fintech strategies have emerged as a beacon of innovation, reshaping the landscape of traditional banking.

Offshoring, a strategic maneuver often employed by Fintech companies, stands at the forefront of this transformation.

It is not just a cost-saving tactic – but a comprehensive growth strategy redefining the way financial servicing are globally-delivered.

Cost Benefits of a Global Talent Pool

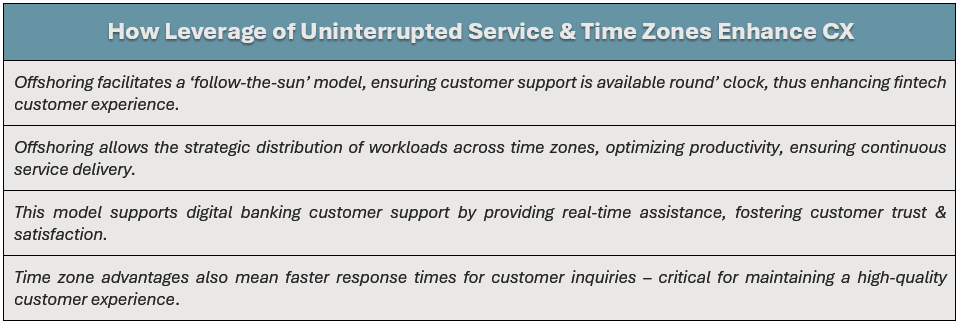

Uninterrupted Service & Time Zone Leverage

Diversity & Multilingual Capabilities

Case Studies: Offshoring Success

- Square: Square’s offshoring strategy has been pivotal in its expansion, allowing the company to provide comprehensive financial services to a growing customer base while maintaining high customer satisfaction levels.

- Tala: Tala’s use of offshoring has been instrumental in reaching underserved markets, providing vital financial servicing, demonstrating the transformative impact of Fintech on financial inclusion.

Offshoring presents Fintech companies with an opportunity to optimize costs, expand service hours, and embrace cultural diversity – all of which are crucial for delivering superior customer experience, driving long-term growth.

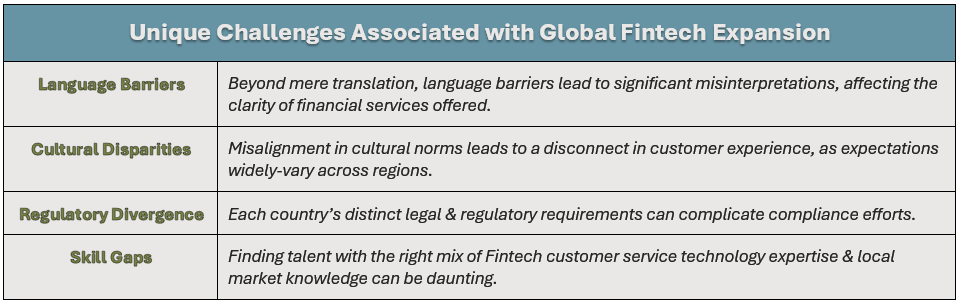

Overcoming Challenges: International Labor Markets

In the dynamic world of Fintech, companies are increasingly-facing the intricacies of international labor markets.

As they venture into new territories, the need for a robust strategy to manage these complexities becomes paramount.

The goal is to establish a workforce understanding the technical aspects of Fintech solutions – and resonates with the CX ethos the industry demands.

Common Hurdles

Best Practices for Offshore Staffing

Legal & Regulatory Frameworks

A deep understanding of legal & regulatory frameworks is non-negotiable.

Your Fintech company must:

- Stay abreast of the ever-evolving regulations impacting banking (digital) & payment systems.

- Implement robust compliance training to ensure staff is aware of their responsibilities and the consequences of non-compliance.

By addressing the challenges of international labor markets with strategic practices, your Fintech company will construct a resilient offshore team, well-equipped to deliver exceptional financial services, enhancing fintech customer experience, fostering lasting customer loyalty.

The integration of comprehensive training, effective communication, and adaptability will ensure the team meets & exceeds customer expectations in the ever-evolving landscape of Fintech strategies.

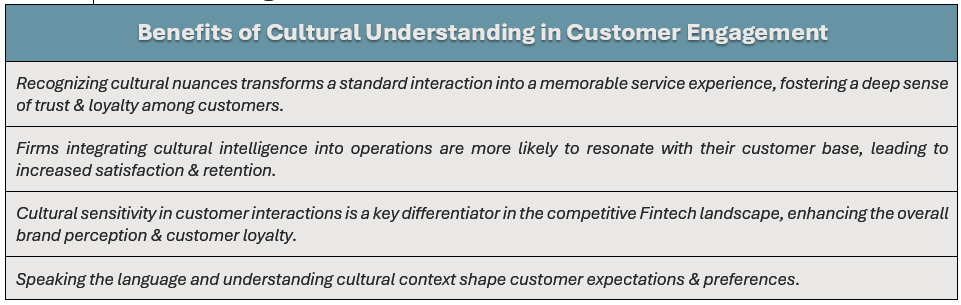

Cultural Nuances – Their Impact on Customer Experience

In the realm of Fintech, where transactions cross borders as swiftly as data travels through the internet, understanding cultural nuances becomes a cornerstone for delivering exceptional CX.

The ability to navigate the complex web of global cultures is both an advantage, and a necessity, for Fintech strategies aiming to create a lasting impact in the market.

Cultural Understanding in Customer Interactions

Strategies for Cultural Awareness

Anecdotes of Cultural Resolution

- Case Study: Revolut, a leading Fintech firm, faced challenges in its expansion into Asian markets; by implementing a culturally-adaptive communication strategy, collaborating with local partners, Revolut has been able to witnessa significant increase in user engagement & satisfaction, highlighting the importance of cultural adaptability in global Fintech strategies.

The integration of cultural nuances into CX strategies is imperative for Fintech companies, such as your own, to excel in the global marketplace.

By investing in cultural awareness, leveraging technology, you can ensure that your Fintech strategies & digital banking customer support are effective & culturally-resonant.

This leads to enhancing fintech customer experience, Fintech payment system improvements, and robust multilingual Fintech support services, driving long-term growth & customer loyalty.

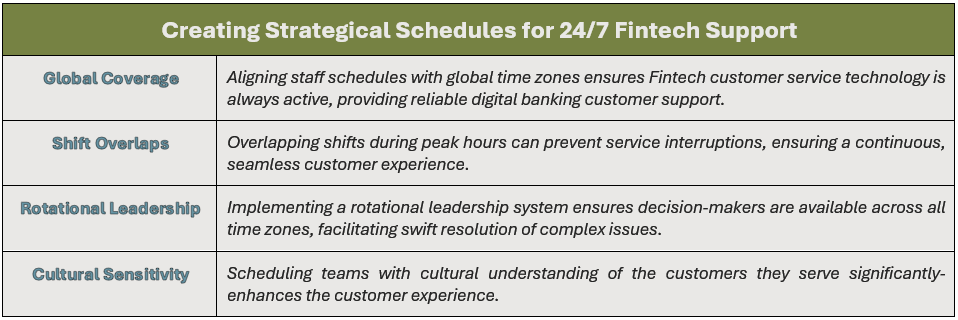

Time Zone Differences & Service Delivery Optimization

In the global arena of Fintech, where banking (digital) knows no boundaries, the mastery of time zone differences is crucial – being about availability and the optimization of service delivery – to ensure a consistent, high-quality CX.

Strategic scheduling becomes the linchpin in this endeavor, allowing Fintech strategies to provide seamless support, enhancing CX & operational efficiency.

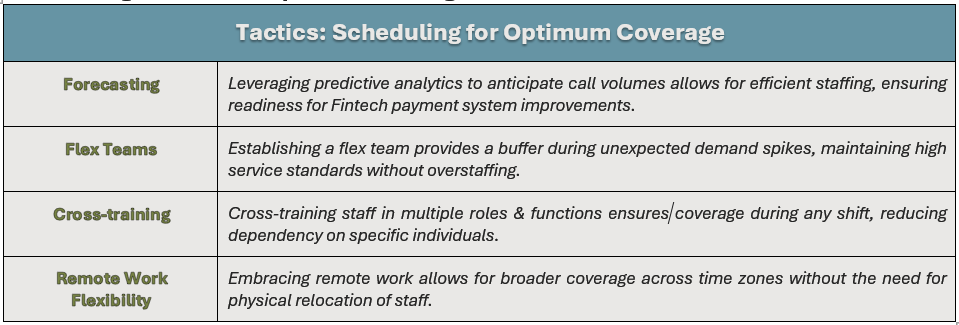

Strategic Scheduling for 24/7 Support

Scheduling Tactics for Optimal Coverage

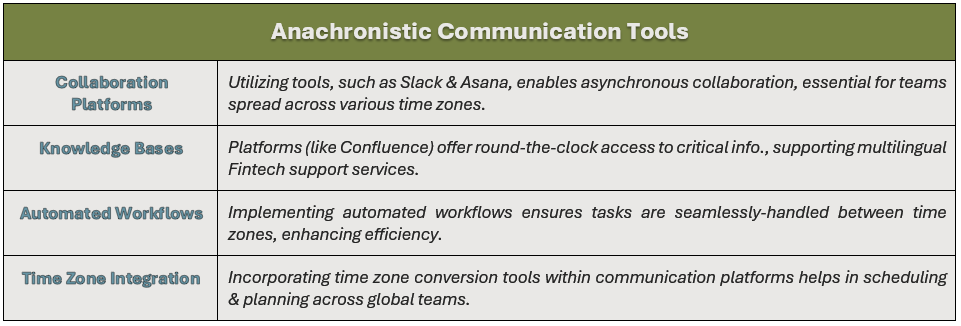

Asynchronous Communication Tools

By embracing strategic scheduling, harnessing the power of technology, your Fintech business can transcend time zone barriers, delivering optimized service that aligns with customer needs & schedules.

This approach fosters loyalty, positioning your business for sustained success in the competitive world of financial services.

Callnovo Contact Center’s Approach to Offshore Customer Service

In the fast-paced domain of Fintech strategies…

Callnovo’s approach is a testament to their commitment to providing Fintech companies and their clientele with an unparalleled CX.

Callnovo’s strategies are meticulously-crafted, reflecting a deep understanding of the nuances defining the Fintech industry.

In-depth Analysis: Tailored Customer Service Solutions

Callnovo’s Fintech customer service technology is a symphony of customized services that harmonize with the unique rhythm of each Fintech firm’s requirements.

Callnovo’s offerings are backed by a wealth of industry experience, as well as a deep understanding of the financial services sector – ensuring every digital banking interaction is seamless & secure.

Top-Tier English-speaking Support Personnel

The cornerstone of Callnovo’s success is its English-speaking support personnel.

Callnovo’s recruitment process is rigorous, involving language proficiency tests & situational judgment assessments to ensure that only the best candidates are selected to represent Fintech firms.

Once onboard, continuous training ensures these professionals remain at the forefront of enhancing Fintech customer experience.

Training Initiatives & Cultural Competency Programs

Callnovo Contact Center’s training initiatives are a testament to their dedication to excellence in the Fintech industry.

Their comprehensive approach goes beyond procedural knowledge, delving into the intricacies of Fintech strategies and the subtleties of customer interactions.

This multifaceted training ensures every customer support interaction is a transaction – and a personalized engagement enhancing the CX.

- Product Mastery: Callnovo ensures that personnel are familiar, and proficient, in the various Fintech strategies they support, enabling them to handle complex queries with ease.

- Soft Skills Excellence: The emphasis on soft skills development is crucial, equipping Callnovo’s team to handle sensitive customer interactions with empathy & patience, key components of an outstanding customer experience.

- Cultural Agility: Callnovo’s focus on cultural sensitivity prepares their team to provide multilingual Fintech support services, ensuring clear communication & cultural resonance with a diverse global customer base.

- Continuous Learning: Callnovo’s commitment to ongoing education keeps their team updated on the latest trends in Fintech customer service technology, ensuring they remain at the cutting edge of service delivery.

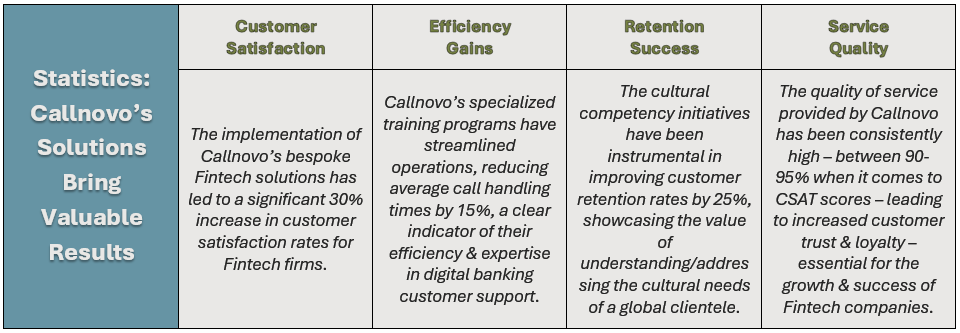

Data & Statistics

Callnovo’s tailored solutions are not just innovative – but effective.

The impact of Callnovo’s training & service strategies is evident in the tangible improvements seen across various metrics.

This powerful combination is the driving force behind their ability to deliver exceptional service, ensuring Fintech companies retain their customers and also attract new ones, fostering long-term loyalty, contributing to sustained business growth.

By prioritizing the enhancement of Fintech CX, investing in Fintech payment system improvements, Callnovo sets a benchmark for customer service excellence in the Fintech sector.

Conclusion

In conclusion, the journey through the intricacies of offshore customer service has illuminated the pivotal role of Callnovo Contact Center in enhancing the CX for Fintech companies.

By integrating Fintech strategies with banking (digital) & payment systems, Callnovo ensures financial services are delivered with precision & cultural sensitivity.

Callnovo’s Fintech customer service technology is a pathway to enhancing Fintech CX, fostering enduring customer loyalty.

These advantages are crucial for Fintech entities, like your own, to scale & succeed in today’s market.

With Callnovo’s Fintech payment system improvements & multilingual Fintech support services, your Fintech firm can be well-equipped to navigate the challenges of a global customer base.

If you’re striving for excellence in customer service, you should consider partnering with Callnovo Contact Center.

Callnovo’s expertise & tailored solutions are the keys to unlocking enhanced customer engagement, securing a future of growth & success.